Mumbai: India’s retail investors opened a record amount of new accounts last year, even as an exodus of foreign investors began to weigh on the multi-year rally in the nation’s stocks.

While volatility has battered the U.S. retail horde of late, Indian market watchers including Dharmesh Mehta, chief executive of Mumbai-based DAM Capital Advisors Ltd., expect the torrid inflow of local moms and pops to continue.

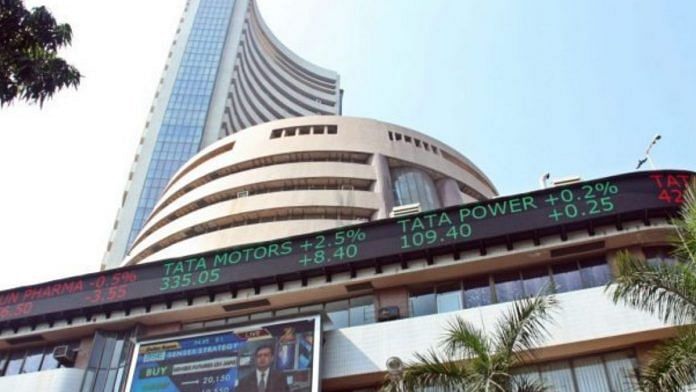

Individuals opened an all-time high of 31 million stock-trading accounts during 2021 — more than Australia’s entire population — according to data released at the end of January by the Securities & Exchange Board of India. The pace accelerated to over 3 million per month in the last quarter, even as selling by overseas traders pushed the S&P BSE Sensex toward a technical correction.

Foreigners have continued to sell Indian stocks, with their withdrawals totaling nearly $10 billion since the end of September. The outlfow comes as concerns have grown over valuations after a series of all-time highs for local indexes and the epic flop of the initial public offering for digital-payments firm Paytm.

“Indian markets will continue to gain momentum, be it in terms of new listings or new account openings,” said DAM Capital’s Mehta. The IPO manager expects new listings in India, which raised a record $18 billion in 2021, to keep attracting retail investors as more individuals seek exposure to stocks as an asset class.

Arijit Malakar, head of retail equity research at Kolkata-based Ashika Group, expects individual account openings to pick up even further on strong interest in the upcoming listing of Life Insurance Corp. of India, which is expected to the nation’s largest-ever IPO.-Bloomberg

Also read: Shares for Gautam Adani’s food venture climbs in market debut