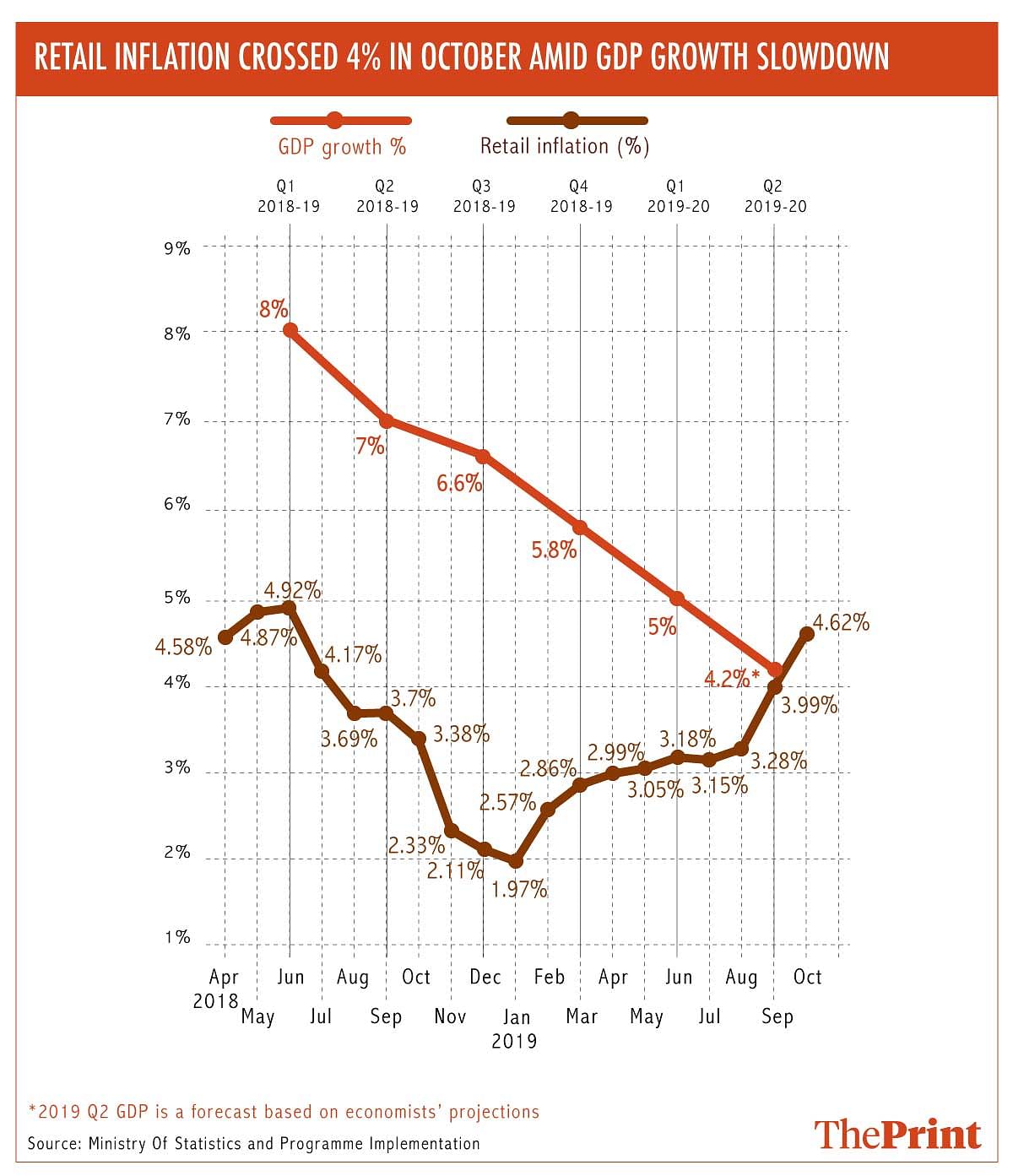

New Delhi: The sharper-than-anticipated increase in retail inflation in October — to 4.62 per cent — will limit the scope of Reserve Bank of India rate cuts in stopping the slide in India’s GDP growth, economists have said.

Retail inflation based on the Consumer Price Index rose sharply for the third consecutive month, with the October figure representing a 16-month high after food prices, especially those of vegetables and pulses, surged.

Data released by the Ministry of Statistics and Programme Implementation showed that food inflation was at 7.79 per cent in October, a steep climb from 5.11 per cent registered in September.

The RBI’s monetary policy committee (MPC) is mandated by law to target retail inflation of 4 per cent, with an upper tolerance level of 6 per cent and a lower tolerance level of 2 per cent. The sharp increase in retail inflation will make it difficult for the MPC to go in for a larger magnitude rate cut in its next meeting. The fifth bi-monthly monetary policy announcement is slated for 5 December, a week after the government releases the second quarter GDP numbers on 29 November.

Devendra Pant, chief economist and senior director of public finance at India Ratings & Research, said: “Although headline CPI inflation in October 2019 has breached the central point of RBI’s inflation-targeting framework, the increase is due to seasonal items and strong base effect.”

Pant added that with the economy in slowdown, “growth concerns will dominate the RBI’s monetary policy review”, and that RBI will “continue with accommodative policy and expect further rate cut in the policy review of December 2019”.

Aditi Nayar, principal economist at rating agency ICRA, said the inflation could come in higher than 4 per cent for the remainder of FY 2019-20, complicating policy choices.

“The sharp uptick in the CPI inflation in October 2019 has contrasted with the industrial contraction recorded in September 2019,” she said in a note, adding that the “extent to which the Q2 FY2020 GDP growth reading eases further from the 5.0 per cent recorded in the previous quarter, will influence the MPC’s decision on whether to cut rates further, and by how much, in the December 2019 policy review.”

Also read: SBI revises full-year GDP growth forecast to 5%, and 4.2% for July-September quarter

Spate of weak indicators

A string of weak economic data has prompted many economists to forecast that GDP growth in the July-September quarter will fall below the 5 per cent recorded in the April-June quarter. Data released by the government Monday showed that Index of Industrial Production (IIP) contracted by 4.1 per cent in September, the second consecutive monthly contraction, after the 1.4 per cent registered in August. The factory output growth number was the lowest since the adoption of the 2011-12 base year, and the first time since October 2011, when the 2004-05 base year was in effect, that a dip of this magnitude was registered.

Institutions like the State Bank of India and Japanese brokerage firm Nomura have forecast that India’s economy will grow at only 4.2 per cent in the second quarter. The full-year growth forecasts have also been revised downwards by many institutions. The most pessimistic forecast so far has been from Nomura, which forecast that the full-year growth will be at 4.9 per cent, followed by SBI, which estimated it at 5 per cent.

Also read: The 2020 economy should feel a lot better

Muted inflation was the only silver lining. The RBI should stay ahead of the curve in dealing with this spike.