Mumbai: India’s economic soft patch has put Asia’s most dovish central bank on notice, yet again.

Growth cooled to 5.8% in the first three months of the year, the slowest pace in several quarters, according to a government report on Friday. That took the expansion in the fiscal year to March 2019 to 6.8%, lower than the 6.9% median estimate in a Bloomberg survey.

Despite the central bank’s two interest-rate cuts this year, borrowing costs in the economy aren’t coming down fast enough. Liquidity has also dried up in recent months as demand for cash picked up ahead of India’s six-week election.

That’s kept a lid on investment and consumption in the economy, and adds to pressure on the central bank to take more easing action this week. Not only by lowering interest rates, but also by adjusting its monetary stance to an accommodative one and injecting more liquidity into the financial system.

“Is there a room for rate cut? Yes, definitely,” said Suyash Choudhary, head of fixed income at IDFC Asset Management Ltd. in Mumbai. “But unless the market is comfortable with respect to expectations on liquidity those cuts will not get fully transmitted.”

Constrained by a widening budget deficit, Prime Minister Narendra Modi — who was sworn into office for a second term last week — may increasingly look to the Reserve Bank of India for help in spurring lending and growth. Inflation has also been relatively benign, well below the bank’s 4% medium-term target, giving policy makers ample room to ease.

Despite the central bank pumping in cash via open market bond purchases and foreign exchange swaps, financial conditions have been tight in the past few months.

According to Deutsche Bank AG, the net deficit on rupee liquidity has averaged $8 billion in the past six months. The Reserve Bank of India will look to possibly shift towards a surplus of between $2 billion to $4 billion over the next six months as it tries to fix the problems with the shadow banking sector and improve policy transmission, it said in a report.

What Bloomberg’s Economists Say

“We expect the RBI to reduce the repo rate by another 25 basis points at its June 6 policy review and — importantly — shift to targeting a surplus in banking system liquidity to counter a slowdown in growth.” He sees the RBI’s terminal rate at 5.25%, implying two more rate cuts after a June move.

— Abhishek Gupta, India economist

The central bank plans to publish more information on how it assesses liquidity conditions in the banking system in an effort to provide greater clarity to the market, people familiar with the matter told Bloomberg.

Bond yields have eased in the past three weeks, mirroring a global rally in debt. The yield on the benchmark 10-year security dropped 10 basis points on Friday to 7.03% , the lowest since December 2017.

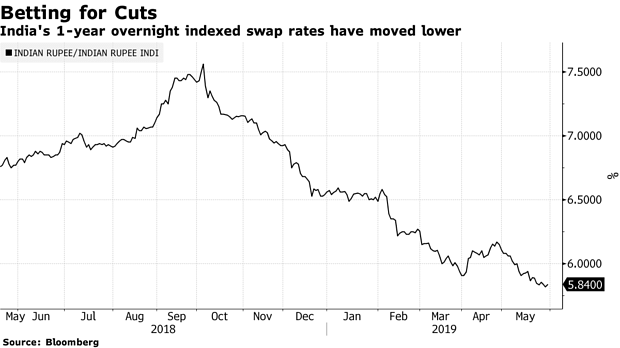

“The market appears comfortable with further RBI cuts with short-term yields and swaps pushing lower post elections,” said Eugene Leow, a rates strategist at DBS Group Holdings Ltd. in Singapore. “We think that the market is on point with the next cut likely to come in June.”

Also read: New RBI guidelines to squeeze profit margins of NBFCs

Below are key Asian economic data and events due:

- Monday, June 3: Japan capital spending, manufacturing PMI across Asia, Malaysia trade balance

- Tuesday, June 4: South Korea GDP, South Korea CPI, Thailand CPI

- Wednesday, June 5: South Korea FX reserves, South Korea balance of payments, Taiwan CPI, Services and composite CPI across Asia

- Thursday, June 6: Thailand consumer confidence, RBI rate decision

- Friday, June 7: Thailand forex reserves

— With assistance by Ronojoy Mazumdar

— Bloomberg

It will not help.