Mumbai: The Reserve Bank of India (RBI) has revised its GDP growth estimate for the current financial year to -7.5 per cent compared to its earlier forecast of -9.5% projected during the October review of the policy.

In its bimonthly monetary policy review announced Friday, the six-member monetary policy committee (MPC) of the central bank also decided to keep the repo rate unchanged at 4 per cent, as widely expected, while continuing with the accommodative stance.

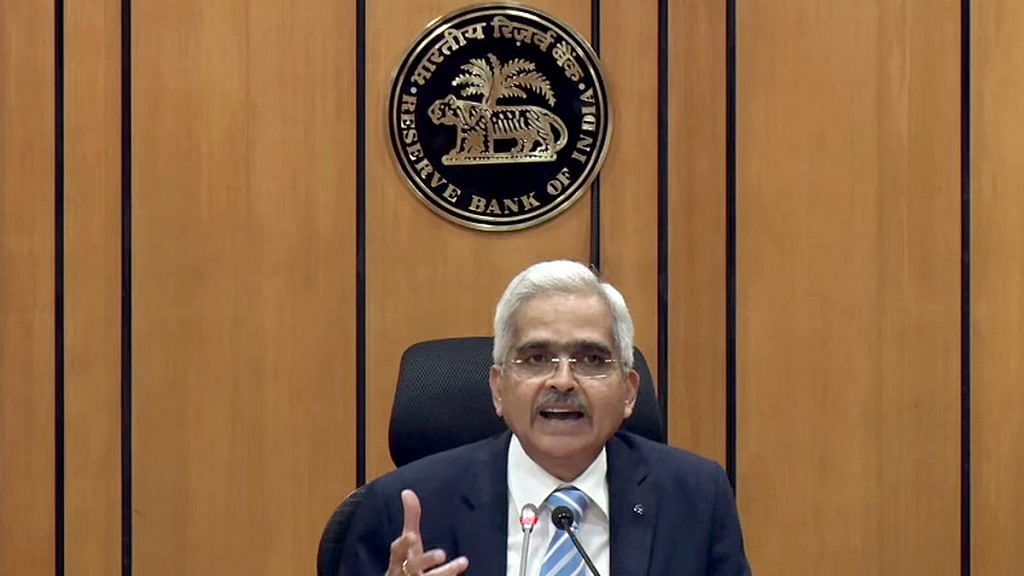

“It [the monetary policy committee] decided to maintain the accommodative stance as long as necessary, in the current financial year and into the next year to revive growth on a durable basis and to mitigate the impact of Covid-19 while ensuring inflation remains within the target going forward ” RBI Governor Shaktikanta Das said.

All the six members of the MPC voted in favour of maintaining the status quo. This was the third consecutive policy where the RBI kept the interest rates unchanged, after cutting it by a total 115 bps in March and May.

The decision to hold interest rates comes at the backdrop of stubborn inflation, which has been above the central bank’s upper tolerance limit of 6 per cent for seven months. The mandate of the central bank is to maintain CPI inflation at 4 per cent, with a variation of +/- 2 per cent.

Growth, inflation forecast

The upward revision of the growth numbers comes after less than expected contraction of GDP during the July-September period, which was -7.5 per cent compared to -9.5 per cent projected by the RBI in October.

The stock markets reacted positively to the growth revision with the BSE Sensex hitting 45,000 for the first time ever.

The central bank has now projected growth to enter the positive territory in the second half of the financial year, with GDP growth for the third quarter seen as 0.1% and for the fourth quarter as 0.7%. Growth is seen to bounce back to 6.5 per cent in the first half of the next financial year.

The RBI also projected the CPI inflation for the third quarter to be at 6.8% for the October-December quarter and for the fourth quarter to be at 5.8%.

CPI inflation was projected at 6.8 per cent for second quarter of 2020-21, at 5.4-4.5 per cent for the second half of 2020-21 and 4.3 per cent for Q1 of 2021-22.

“The growth impulses that have emerged augurs well for the revitalisation of the Indian economy. Policy stimuli by the government and RBI are intended to nurture this growth sprouts to greater strengths” Das said.

Also read: There are checks & balances — RBI panel member defends bank licences to corporates push

Not blinking to inflation pressure

Economists noted that the RBI continues to focus on growth even as inflation pressures persist. This means the interest rates will not be hiked any time soon as the central bank chooses to look through the inflation spike.

“The RBI resisted blinking despite the high inflation glare,” said Aurodeep Nandi, India economist, Nomura.

“…the RBI has essentially doubled down on its October accommodative guidance and asserted that inflation remains largely supply side driven and that supporting growth remains its paramount priority. Our baseline projection is that the RBI will continue keeping policy rates on hold in the near future,” he said.

RBI noted that the recovery in rural demand is expected to strengthen further, while urban demand is also gaining momentum as unlocking spurred employment activities. At the same time, the central bank raised concern on a possible rise in Covid-19 infections in some parts of the country, which could prompt some local containment measures.

However, MPC also observed that private investment is still slack and capacity utilisation has not fully recovered.

On inflation, the MPC is of the view that it is likely to remain elevated, barring temporary relief during winter months from prices of perishables.

“This constrains monetary policy at the current juncture from using the space available to act in support of growth. At the same time, the signs of recovery are far from being broad-based and are dependent on sustained policy support. A small window is available for proactive supply management strategies to break the inflation spiral being fuelled by supply chain disruptions, excessive margins and indirect taxes,” the RBI said.

“The MPC adopted a wait-and-watch approach amid evolving growth–inflation dynamics,” said Madhavi Arora, lead economist, Emkay.

“The MPC noted the inflected growth momentum while also reckoned that the narrative of eventual fall in inflation with easing supply shocks is yet to play out. However, the dovish language of October policy was maintained,” she said.

Also read: Why RBI has restricted HDFC bank from launching new digital facilities, issuing credit cards

2020 – A year to remember

Das also said that the current year, marked by the Covid-19 pandemic and economic losses greater than the Great Depression of the 1930s, is a “one to remember”. “Throughout this period, the Reserve Bank acted pre-emptively to face head-on the challenges posed by the virus and manage the fallout of the pandemic on the Indian economy,” he said.

“Our overall endeavour is that going forward, output and employment losses get quickly recouped in an environment of macroeconomic and financial stability,” he added.

He said preservation of financial stability and depositors’ interest is uppermost in the central bank’s agenda, adding that, “we could swiftly resolve the situation at two scheduled commercial banks.”

Das also reminded that the Reserve Bank’s role as the debt manager and the banker to the government was tested to the hilt in 2020, marked by the highest ever level of market borrowing.

“Our policies have resulted in the lowest weighted average cost of borrowing in 16 years and the highest weighted average maturity of the stock of public debt on record,” he added.

This report has been updated with more details from the RBI governor’s press conference.

Also read: Yes Bank, PNB crises shows why RBI needs a data-first approach to supervision