The central bank’s decision is expected to help extend a rally in the bond market, triggered last week when the government cut its first-half borrowing plans.

India’s central bank kept interest rates unchanged for the fourth straight meeting and cut its inflation forecast citing lower food prices, sparking a renewed rally in the bond market.

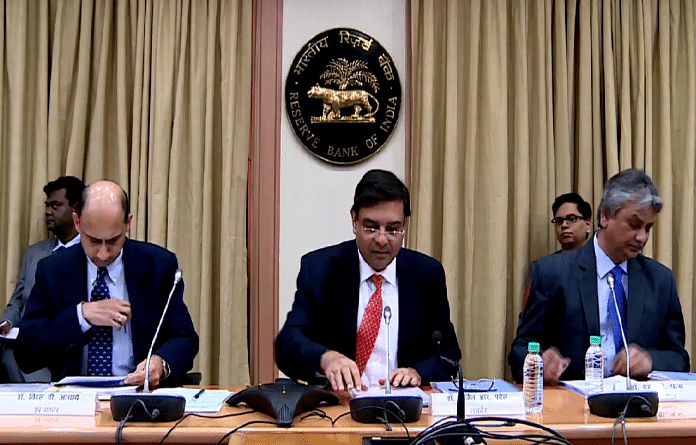

Reserve Bank of India Governor Urjit Patel and his monetary policy committee retained the benchmark repurchase rate at 6 percent on Thursday, as predicted by all 42 economists in a Bloomberg survey. Five of the six-member MPC voted for the decision, while one sought a hike.

“Overall food inflation should remain under check on the assumption of a normal monsoon and effective supply management by the government,” the Reserve Bank of India said in a statement in Mumbai. It retained its neutral policy stance.

The decision helped extend a rally in the bond market, triggered last week by the government’s decision to cut its first-half borrowing plans and after the RBI on Monday allowed lenders to spread their debt market losses over four quarters.

The yield on the benchmark 7.17 percent sovereign notes maturing 2028 fell 11 basis points to 7.19 percent. The rupee gained 0.3 percent to 64.9750 per dollar and the main equity index was trading up 1.7 percent as of 3:15 p.m. in Mumbai.

Patel said fiscal slippages from the federal as well as state governments and a below-normal monsoon meant that risks to inflation were on the upside. Companies polled by the RBI said input and output prices were rising and this could be passed on to consumers.

Key Points

Cuts inflation forecast for first-half of fiscal year started April 1 to a range of 4.7 percent-5.1 percent from 5.1 percent-5.6 percent; second-half forecast at 4.4 percent from 4.5 percent-4.6 percent Reiterates commitment to keep inflation at 4 percent in medium-term Sees GDP growth at 7.4 percent in fiscal 2019 from 6.6 percent the previous year, “with risks evenly balanced” RBI warns rising trade protectionism and financial market volatility could derail global recovery; says Indian companies and banks must continue cutting debt Central bank exploring creation of a digital currency; forms panel to study and submit report by June

‘Goldilocks’ Economy

“The Goldilocks scenario that RBI has outlined for the new fiscal year — with higher growth expectations and lower inflationary forecasts — could very well indicate rates on hold for the whole year,” said Rajni Thakur, economist at RBL Bank Ltd. in Mumbai. “It will boost the general market sentiments and bond markets in particular.”

Investment banks such as Goldman Sachs Group Inc. expect India to grow at 7.6 percent in the year started April 1, amid rising demand in the economy. The central bank has also turned more upbeat on the growth outlook following the recent run of positive economic activity data.

India’s dominant services sector bounced back into expansionary territory in March. The Nikkei India Services Purchasing Managers’ Index rose to 50.3 in March from 47.8 in February. The rise came amid greater inflows of new work orders, an improvement in business sentiment with job creation quickening to its strongest pace since June 2011. A number below 50 indicates a contraction.

A similar survey, earlier in the week, showed the manufacturing sector growing, albeit at a slower pace.

“There are now clearer signs of revival in investment activity,” the RBI said in the statement. “Global demand has been improving, which should encourage exports and boost fresh investment.” —Bloomberg