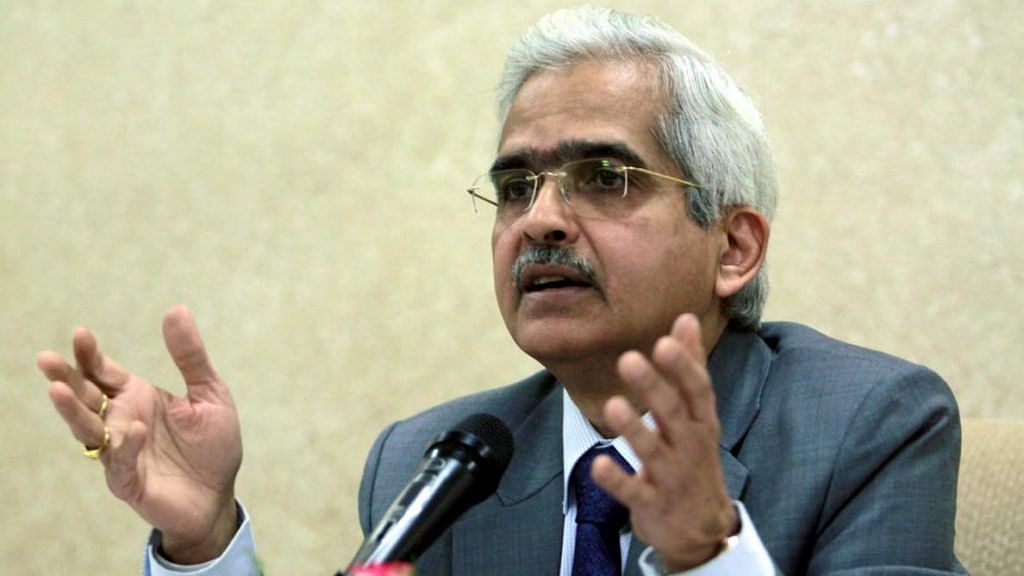

Mumbai: The Reserve Bank of India would prefer a market-led resolution to the nation’s simmering shadow banking crisis, Governor Shaktikanta Das said, dashing hopes for bailouts in the struggling sector.

“We are monitoring the top 50 non-bank finance companies, which account for 70%-75% of the sector loans outstanding,” Das said at the Bloomberg India Economic Forum in Mumbai late Thursday. “The first preference would be to have the market mechanism resolve the problems of NBFCs, which involves inflow of resources either by stake sale, bringing in new promoters, or securitisation of assets.”

Also read: India’s current account deficit is at risk from global slowdown & oil prices: RBI Governor

A year has passed since the government seizure of shadow lender Infrastructure Leasing & Financial Services Ltd. roiled markets, yet the crisis has deepened as more shadow lenders including Dewan Housing Finance Corp., Reliance Home Finance Ltd. and Altico Capital India Ltd. have defaulted or faced rating downgrades. Investors are now concerned about the impact of an NBFC collapse on the wider financial sector and a funding crunch in an economy where growth has slowed to a six-year-low.

“Relying completely on market forces to deal with the challenges faced by the NBFC sector is way too optimistic,” Navneet Munot, chief investment officer at SBI Funds Management Pvt., said at the forum. “We need a regulatory mechanism to deal with a default by the non-bank entity. We required intervention from policy makers much more than what we have seen so far.”

Also read: Modi’s goal of making India a $5 trillion economy by 2025 is facing big risks

Policy makers have previously announced steps including a backstop liquidity window via banks, partial credit guarantees and relaxation of banks’ exposure limits to NBFCs to ease credit flow to the shadow banking sector.- Bloomberg