The cost of funds for exporters and importers has risen as industries are forced to seek new credit tools with smaller enterprises taking the largest hit.

New Delhi: Banks weren’t the only victims of fugitive jewelers Nirav Modi and Mehul Choksi, who allegedly orchestrated a $2 billion fraud. India’s trade may be an unsuspecting casualty.

As the fraud unraveled, the central bank stepped in and banned short-term financing in foreign currency called Letters of Undertaking to limit the damage to the financial system. The result was the cost of funds for exporters and importers rose as the industry was forced to seek new credit tools, said Ajay Sahai, director general of the Federation of Indian Export Organisations in New Delhi.

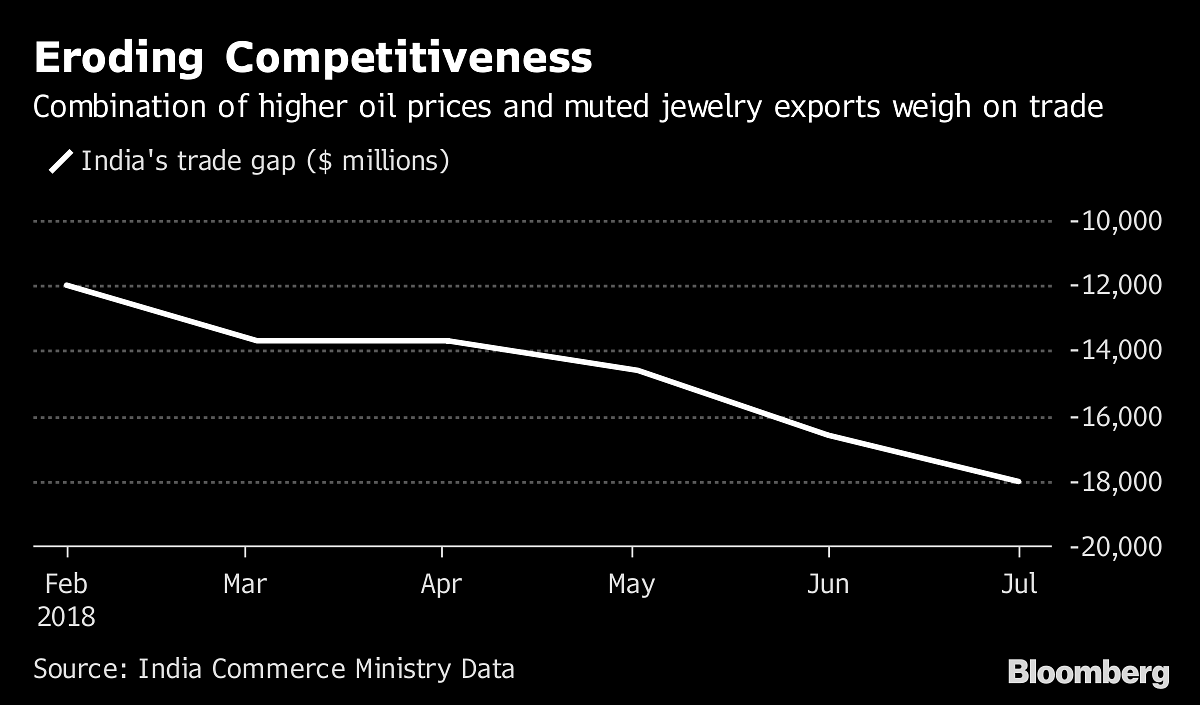

The worst hit are the smaller enterprises as the ban is eroding their margins and competitiveness. Trade credit is tough to secure after jeweler Modi used fake letters to obtain loans in banks abroad. That threatens to choke shipments of gems and jewelry — the nation’s third-biggest export — and widen the trade deficit, which is already the biggest in five years mainly on account of higher oil import bill.

Total gems and jewelry exports in the April-July period fell by 1.5 percent from a year ago to $13.7 billion, while imports of precious stones — a key input for exports — dropped by 19.5 percent to $9.84 billion during that time.

“The banning of LoUs was a serious blow,” said Amitendu Palit, a senior research fellow at the National University of Singapore. “It is not just jewelry exporters that have been affected, but others also. An alternative must be found, such as allowing LoUs with safeguards.”

That view was echoed by a Parliamentary panel, which in a report last month sought restoration of the trade finance tool at the earliest. The Reserve Bank of India “got unnerved” by the fraud at Punjab National Bank and the ban was a “knee-jerk reaction”, it said, while flagging risks for cost competitiveness of trade and the cascading effect on jobs.

Biggest Bank Fraud

The panel was referring to the $2 billion bank fraud uncovered in February at India’s state-owned Punjab National Bank, which accused Modi and Choksi of defrauding it. The duo have fled the country and are wanted by Indian courts under a new law on fugitive economic offenders that allows authorities to confiscate their assets.

Though traders still have access to other forms of trade finance such as bank guarantees and letters of credit, the ban on the interim guarantees increases their borrowing costs by about 200 basis points and comes at a huge cost for small traders.

“We all are paying the price for what Nirav Modi did,” said Pradeep Goyal, who runs a metal trading company Agsons Agencies (I) Pvt. “We have spent many sleepless nights over this. My cost has gone up, my cycle has reduced and I’m feeling the crunch.” – Bloomberg