Mumbai: Divergent views are on display on the prospects of India’s currency after Prime Minister Narendra Modi’s thumping election victory.

Citigroup Inc. is positioning for a weaker rupee using options after the currency’s recent outperformance, while Nomura Holdings Inc. expects the sweep of Modi’s win to attract robust overseas flows to the nation’s assets, giving another leg to the rally.

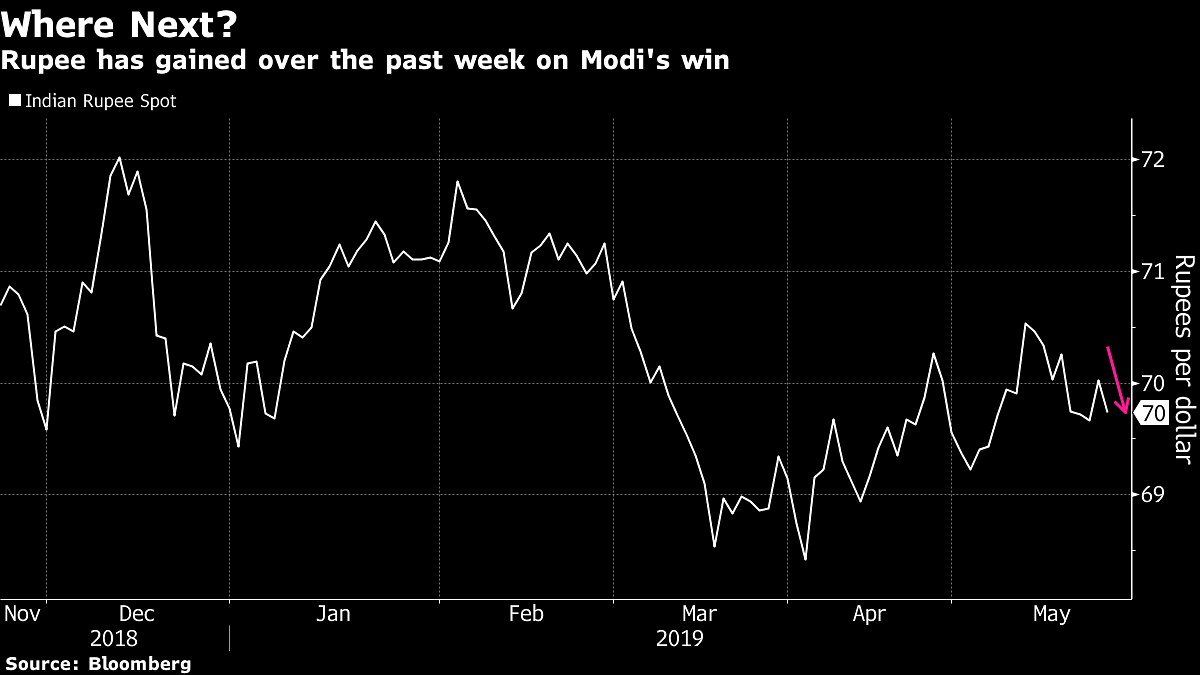

Investor sentiment turned positive last week — the rupee gained one percent and stocks rose to records — after Modi swept to a comfortable victory as predicted by nearly all exit polls. With election outcome settled, markets are now looking to see how the government tackles slowing economic growth.

“Election exuberance is fizzling out quickly,” strategist Gaurav Garg at Citigroup wrote in a note. “The likelihood of the rupee further cheering policy continuity is very low.”

Also read: Victorious Modi faces a $1.4 trillion roadblock

The rupee is likely to under-perform amid wider-than-expected trade deficit, cautious outlook toward emerging markets and risks of oil prices, Garg wrote. Oil is India’s top import item and a major driver of inflation and trade deficit.

His advice: buy 2-month USD/INR 1×2 call spread 71.5 / 73 strikes for a premium of 0.155% NOTE: The rupee is expected to end 2019 at 70 per dollar, according to median estimate in a Bloomberg survey.

Nomura says Modi’s win assures policy continuity and stability craved by investors, which in turn will lead to increased capital inflows. Overseas funds have bought $9.4 billion of local shares this year, the most after China, as they positioned for Modi getting a second term.

“The result is a clear medium-term positive for growth, inflows and rupee, which should also support the relative outperformance versus Asia,” analysts including Sonal Varma wrote in a note.

Goldman Sachs Group Inc. has a balanced stance. While the rupee may grind higher toward 69 per dollar in the next three months, the bank is neutral in the medium term because of the priced-in poll outcome, the currency’s modest overvaluation and a likely widening in the current-account deficit, analysts including Prachi Mishra wrote in a note. -Bloomberg

Also read: Indian markets rally gets reality check after Modi victory mania settles

As far as the economy is concerned, the election result changes nothing. It replenishes the government’s political capital, empowers it to take decisive action to turn things around. The real task of governance and political management in fact would be for even a government formed through coalition to rule by consensus, convince both the opposition and the nation of the need for painful decisions. 2. The first step should be to clean up official data and statistics. Many items of expense pushed to the next financial year will have to be honestly accounted for. Apart from bank privatisation – unclear if several weak PSBs will find buyers, any more than Air India will, NPAs, now at close to thirteen trillion will need to be dealt with; hopes from the new bankruptcy code are fading. The problems in the NBFCs. The world is watching, hopeful, but a little sceptical.