A pattern of events is leading investors to believe that when GDP growth slows down, the NDA will go into overdrive mode to reflate the economy.

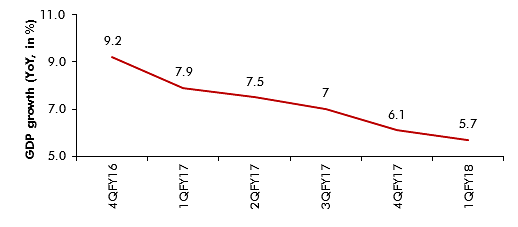

Since the Jan-March 2016 quarter, GDP growth in India has fallen continuously. As of 1QFY18, growth fell to 5.7 per cent (see exhibit below). This has led to mounting discontent evidenced by the 27 September 2017 piece by former NDA Finance Minister Yashwant Sinha in the Indian Express where he says:

“Private investment has shrunk as never before in two decades, industrial production has all but collapsed, agriculture is in distress, construction industry, a big employer of the work force, is in the doldrums, the rest of the service sector is also in the slow lane, exports have dwindled, sector after sector of the economy is in distress, demonetisation has proved to be an unmitigated economic disaster, a badly conceived and poorly implemented GST has played havoc with businesses and sunk many of them and countless millions have lost their jobs with hardly any new opportunities coming the way of the new entrants to the labour market…”

Given the government’s response in expediting action on policy concerns in the wake of falling economic growth, it would not be unfair to say that the NDA is a reactive administration. The fact that the government faces 14 elections in the next 17 months makes it that much more sensitive to comments on its economic performance.

In the last six months itself, several measures have been taken to revive the economy. Karnataka, Maharashtra, Punjab, Uttar Pradesh and more recently Rajasthan announced farm loan waivers, and the GST council lowered rates on 27 products and few services and eased rules for SMEs and exporters. The government also increased the minimum support price (MSP) of wheat by Rs110 (or 7 per cent) a quintal, which is the highest MSP hike in six years. A public sector bank recapitalisation plan of Rs 2.11 lakh crore rupees (US$32.6bn) was also approved to be implemented over the next two years, to try and revive investment in a slowing economy. The government announced an outlay of Rs 6.92 lakh crore (US$107bn) for building an 83,677 km road network over the next five years. Also, Rs1.57 lakh crore (US$24bn) will be spent on the construction of 48,877 km of roads by the state-run National Highway Authority of India (NHAI) and the ministry of road transport and highways.

The above pattern of events is leading investors to believe that there is a Modi put in play; i.e. when GDP growth slows down, the NDA will go into overdrive mode to reflate the economy. Given India’s sliding economic growth and weak EPS growth (Sensex EPS growth has been in single digits for the last four years and seems likely to be in single digits in FY18 as well), the Modi put is as good an explanation as any for the Sensex’s surreal valuation of 24x trailing earnings.

Saurabh Mukherjea is the CEO of Ambit Capital Pvt. Ltd.

This analysis originally appears in ‘The Sceptical CEO’ section of the Ambit website. This post is an excerpt from the analysis ‘Is there a Modi put option?’