New Delhi: The government Friday deleted a tweet that had proposed widening the scope of transaction reporting to include purchase of jewellery and large electrical goods such as televisions and refrigerators (collectively known as white goods) above a certain threshold, domestic business class and foreign travel, and payment of education fees, among other items.

The tweet, made as a part of the government’s social media blitz Thursday on the launch of the tax payer charter, faceless assessment and appeal, had talked about the government’s proposed plan to widen the scope of transaction reporting.

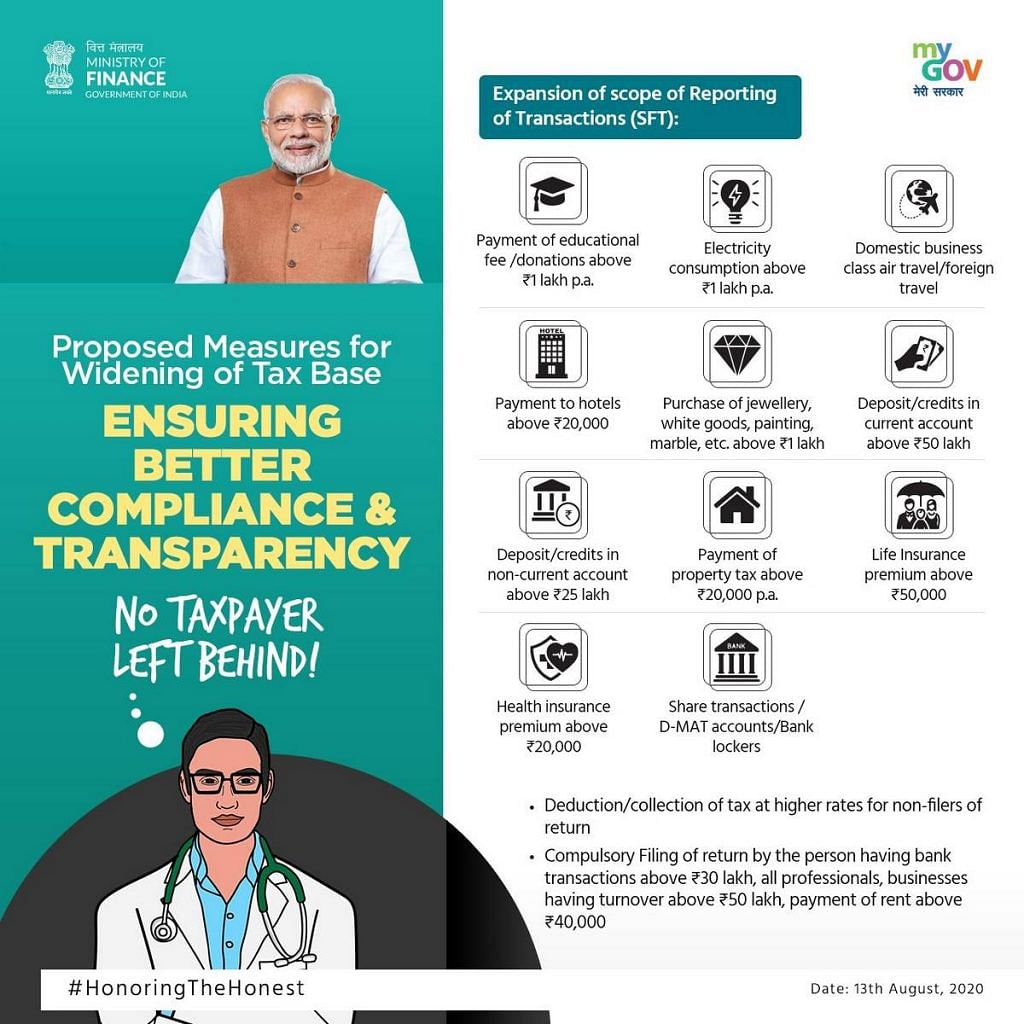

The proposal, which was aimed at widening the tax base, would make it mandatory to report the purchase of jewellery, white goods, marble and paintings of above Rs 1 lakh, payment of education fees and donations of Rs 1 lakh per annum, and domestic business class and foreign travel, along with life insurance premiums of above Rs 50,000, health insurance premiums and property tax payment of more than Rs 20,000, electricity consumption of above Rs 1 lakh, and hotel bills of Rs 20,000.

It was tweeted by the @mygovindia handle, and retweeted by many senior functionaries in the government, before being deleted Friday.

But the infographic continues to be widely available on social media, as it was put out by many other official handles like those of India’s overseas missions. The regional language posts put out by the regional divisions of the Press Information Bureau are also available on Twitter.

But it remains unclear if the government will continue to push the proposal of widening the reporting framework.

Criticism from experts & opposition

The tax department’s proposal had faced a lot of criticism from tax experts and opposition parties, who had pointed out that it would lead to an increase in the compliance burden of firms due to the low thresholds prescribed.

The Congress had said this is “harassment of the honest” and would further tax terrorism.

Also read: Dear young IRS officers, taxing the rich in Covid times is bad economics