Singapore: India equities fluctuated between gains and losses as investors continued to assess Prime Minister Narendra Modi’s improving prospects of re-election and escalating military tension with Pakistan.

The S&P BSE Sensex was little changed at 35,867.44 at the close in Mumbai, trading between a rise of 0.5 percent and a decline of 0.2 percent during the session. The NSE Nifty 50 Index also closed little changed at 10,792.50. Gauges of mid- to small-cap stocks advanced. An abrupt end to U.S.-North Korea summit and the expiry of monthly derivative contracts added to volatility.

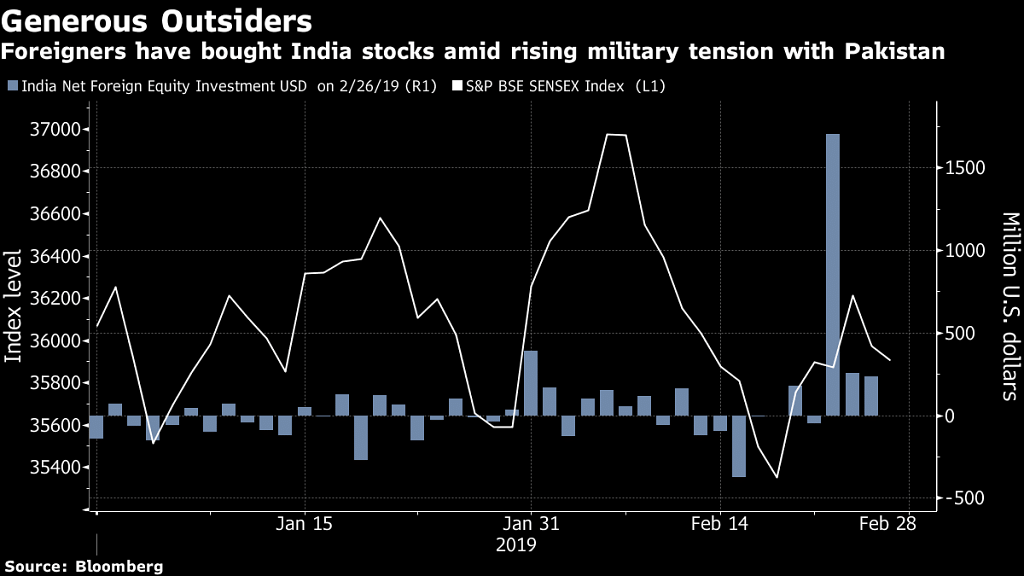

The most serious confrontation in decades between India and Pakistan hasn’t quelled foreign investors’ optimism about Indian equities. Global funds bought a net $487.5 million of shares so far this week, taking the month’s purchases to $2.3 billion, the biggest inflow since November 2017, data compiled by Bloomberg show.

Strategist Views

- “The sudden end of the Trump-Kim summit, the expiry of futures, the ongoing watch for new developments in the conflict with Pakistan prompted traders to pare some positions” in the early afternoon, said Chokkalingam G, managing director at Mumbai-based Equinomics Research & Advisory Pvt.

- “Volatility might persist until derivatives expiry but the focus would soon shift to a pre-election rally as this war-like situation won’t continue for long,” said Deven Choksey, managing director of K.R. Choksey Shares & Securities Pvt. in Mumbai.

- “Pakistan would have to take action against terrorists amid rising international pressure,” he said. “The escalation of border tensions with Pakistan overshadows the economy and markets,” said Prakash Sakpal, an economist at ING Groep NV in Singapore.

- “There are no reasons for pressure to ease on stocks and the rupee as the tensions will likely remain a burning issue going into elections in May,” he said.

- Tension between India and Pakistan “has stunted the rally for now,” Vaishali Parekh, a technical analyst at Prabhudas Lilladher Pvt., wrote in a note on Wednesday. “A break of 10,720-10,700 would bring in more correction.”

The Numbers

- Twenty-six of the 50 Nifty shares and 15 of the 31 Sensex stocks gained.

- 15 of the 19 sector indexes compiled by BSE Ltd. rose, with a gauge of consumer durable goods leading the gains.

- Oil and Natural Gas Corp. was among gainers on the Sensex, while Tata Consultancy Services Ltd. fell the most.

- Jet Airways Ltd. slid as much as 6.3 percent after grounding seven more of its aircraft following non-payment of dues.

Also read: India misses out on investment boom due to election uncertainty