Statistics point to a peculiar feature of India’s high growth phase even as it remains the world’s fastest growing economy

India has retained its status as the world’s fastest growing major economy in the April 2018 edition of the IMF’s World Economic Outlook (WEO). WEO statistics also point towards a peculiar feature of India’s current high-growth phase, though.

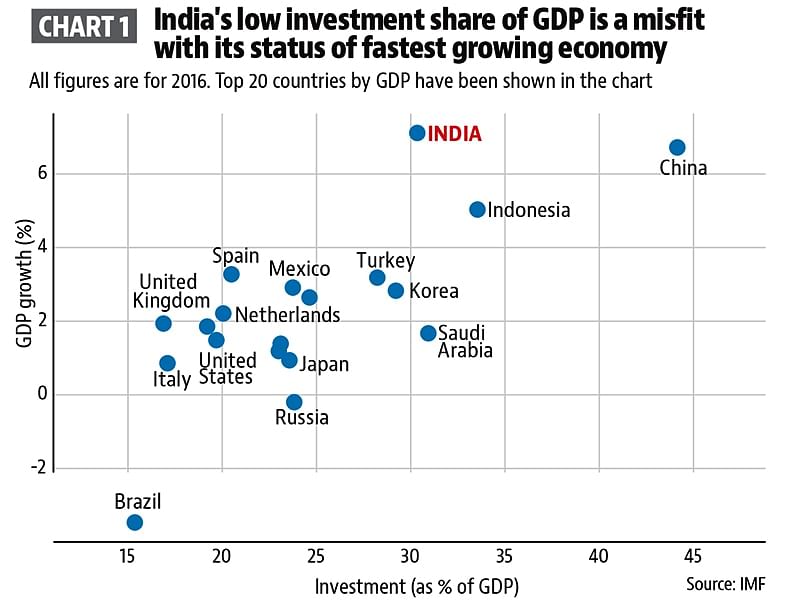

Chart 1 shows a scatter plot of percentage share of investment in GDP and GDP growth rate for the top 20 countries by GDP for 2016. As can be seen, India seems to be an outlier in the group. This is because its high growth rate is accompanied by a relatively low share of investment in GDP.

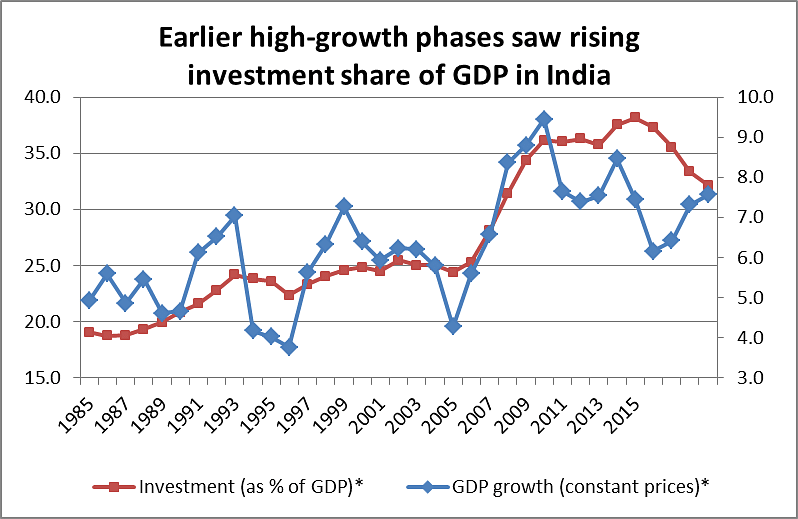

The mismatch between India’s high growth and low investment rate was also pointed out by the Economic Survey a couple of years ago. This discrepancy also shows up when we compare long-term movements in GDP growth rate and share of investment in GDP for India. A revival in growth rate despite a reduction in investment share of GDP, which is what characterises the current phase, has not been seen since the 1980s (See Chart 2).

As can be seen from Chart 2, the previous economic boom in India was characterised by a sharp spike in share of investment in GDP.

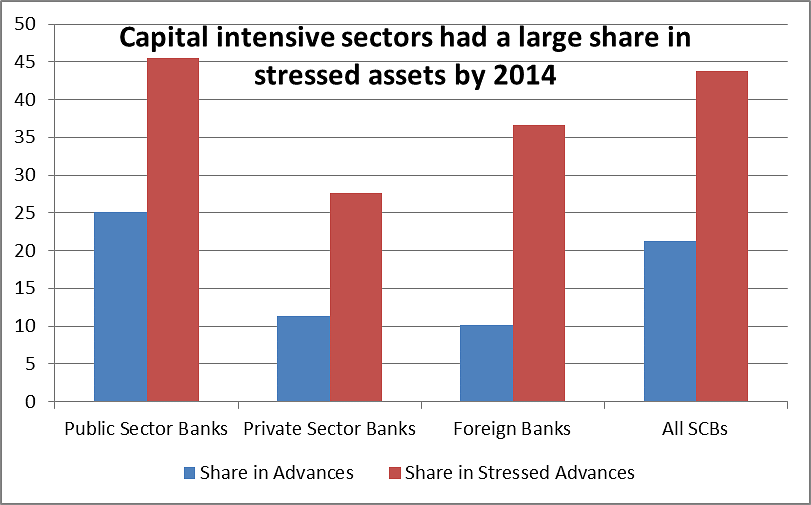

It is from these investments that the majority of India’s bad loans was created. By the end of 2014, capital intensive sectors — mining, iron and steel, infrastructure and aviation — accounted for 44 per cent of the total stressed assets in India’s banking system (See Chart 3). Infrastructure alone accounted for 30 per cent of total stressed advances of scheduled commercial banks (SCBs). The exposure of public sector banks (PSBs) to infrastructure was more than double that of foreign or private banks. Why did infrastructure end up with such a large share of stressed assets? What explains the disproportionate exposure of PSBs to the infrastructure sector?

In a 2013 speech delivered at the Annual Infrastructure Finance Enclave, K.C. Chakrabarty, the then deputy governor of the RBI, blamed banks for the high level of NPAs in the infrastructure sector. “There is enough evidence to suggest that a substantial portion of the rise in impaired assets in the [infrastructure] sector is attributable to non-adherence to the basic appraisal standards by the banks,” Chakrabarty said.

The speech also blames poor appraisal techniques used by PSBs, which had been “more impressionistic rather than being information-based” for a concentration of infrastructure NPAs in PSBs. To be sure, Chakrabarty also pointed towards an over reliance on debt in financing of infrastructure sector projects.

“The infrastructure companies are highly leveraged and the flow of equity in the infrastructure project funding has been very minimal… lack of equity investment in the [infrastructure] project means that the promoter-developer has little skin in the game and the motivation for success of the venture is that much limited,” Chakrabarty said. Former RBI governor Raghuram Rajan once used the term ‘risk-less capitalism’ to describe this phenomenon.

There could be another explanation for the concentration of infrastructure loans in PSBs, though.

A 2017 Economic and Political Weekly paper by Rohit Azad, an assistant professor of economics at Jawaharlal Nehru University, and others, shows that there was a significant spike in infrastructure spending during the 11th and 12th Five-Year Plan periods in India.

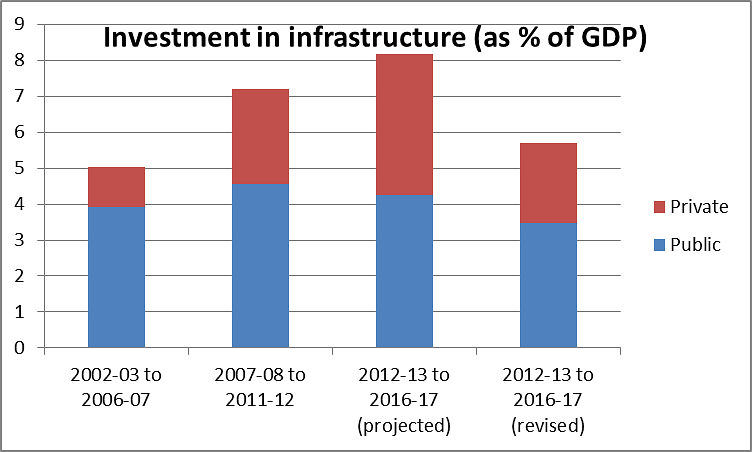

Numbers from the erstwhile Planning Commission show that the percentage share of infrastructure investment in GDP increased from 5 per cent between 2002-03 and 2006-07 to projected levels of 8.2% during 2012-13 to 2016-17.

A large part of this increase was driven by a rise in private sector spending, which was projected to almost match public sector spending in the sector in the 12th Five-Year Plan period (See Chart 4).

The projections did not materialise as bad loans started piling up towards the end of this period. But it is clear that infrastructure push was an important element of growth strategy during this period. If this was the case, it is reasonable to assume that PSBs would have received some sort of a nudge to lend to infrastructure projects. The point being, the lack of due diligence on part of PSBs while lending to infrastructure projects could have been the result of this policy push rather than any individual oversight by bank officials.

Government intervention to channelise credit towards particular sectors via PSB lending is not unprecedented in the Indian economy.

Just a few PSBs lending aggressively to infrastructure would have been enough to force similar actions by others due to fears of losing business.

The strategy created India’s best ever economic boom. The EPW paper cited above says, “Such PSB credit finance investments, particularly in the infrastructure sector, played a crucial role in generating high levels of economic activity in the aftermath of global economic crisis in 2008-09…Such a growth trajectory, however proved to be unsustainable when the expansionary phase came to an end in 2011-12 and bad loans began piling up in the banking system”.

By special arrangement with ![]()

Also read: Public sector banks have a lot to do with India’s banking crisis