UTI AMC expects political uncertainty to play out in the coming months and have the most bearing on government bonds.

Mumbai: Rising crude oil prices and a tumbling currency have already battered India’s $725 billion government bond market. The next focus of risk for the nation’s oldest mutual-fund company now are the upcoming elections.

Revenue from the goods and services tax has undershot the target for five straight months, and UTI Asset Management Co. fears the government may have little scope to cut expenditure before the three key state polls later this year and general elections in 2019.

“Political uncertainty will play out in the coming months that will have the most bearing on government bonds,” Sudhir Agrawal, a fund manager at Mumbai-based UTI Asset, said in an interview. The rupee’s decline, on the other hand, has been in line with fundamentals and “there’s no need to worry excessively about the depreciation,” he said.

Prime Minister Narendra Modi’s Bharatiya Janata Party will contest with the main opposition Congress party in the states of Madhya Pradesh, Rajasthan and Chhattisgarh — all ruled by the BJP — before a national ballot in 2019. The elections are expected to be tight, with the incumbent headed for a loss in Rajasthan, according to a India Today-Axis pre-poll survey conducted in September.

“That’s the point of time I see a lot of volatility,” Agrawal said. Clarity on pre-election alliances will emerge only later in the March quarter, making it “the ideal time to review fund position.”

For now, the political uncertainty and concerns about the impact of surging oil prices on the fiscal deficit has prompted UTI Asset to trim duration of its bond holdings. Agrawal said he prefers debt maturing in three to six months. The $1.6 billion UTI Treasury Advantage Fund that he manages has returned 4.7 percent this year, beating 92 percent of its peers, data compiled by Bloomberg show.

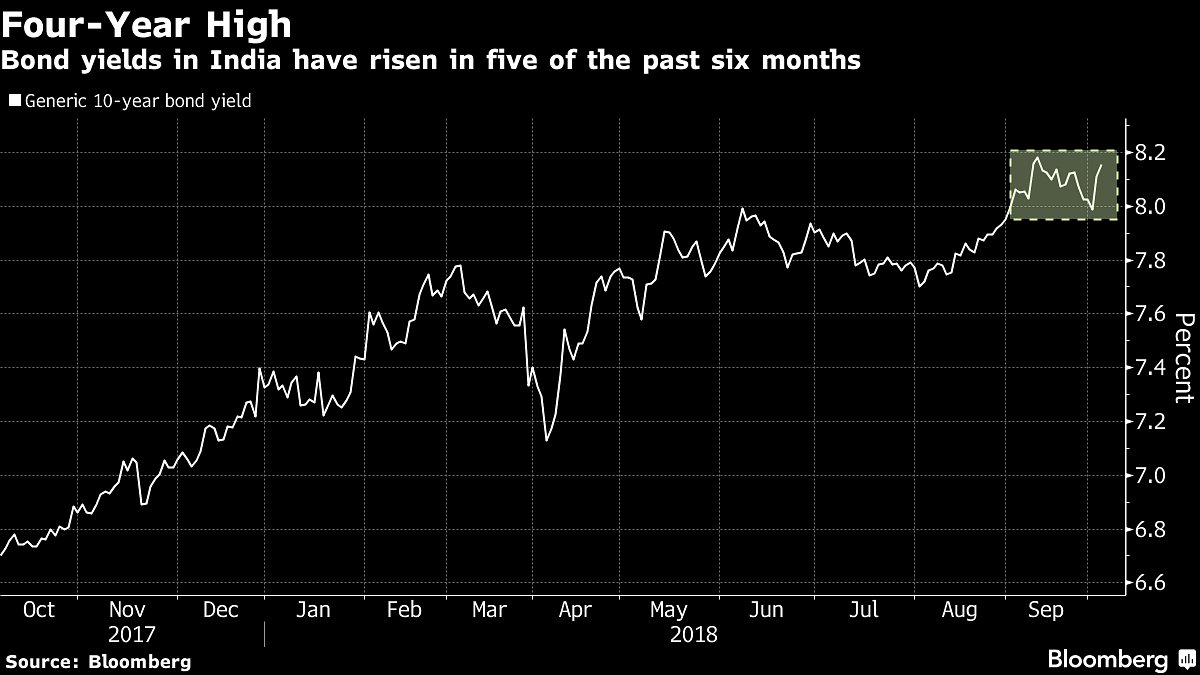

India’s sovereign bonds have been routed by the tumbling rupee and soaring oil prices. The yield on 10-year government bonds climbed to 8.23 percent in September, the highest since November 2014. The Reserve Bank of India’s announcement of $5 billion of bond purchases in October and the government’s truncated borrowing plan have provided some respite.

Some other comments made:

The probability of a 25-basis point hike in October itself is quite high; will assign a 15-20 percent probability of a 50 bps hike; when other EMs with large current-account deficits are hiking, India needs to take steps to stay attractive on a relative basis.NOTE: The RBI will decide on policy rates Friday. Most economists surveyed by Bloomberg expect a 25-basis point increase as the central bank seeks to arrest the decline in the rupee, Asia’s worst-performing currency in 2018. We are not in the 2013 scenario when the currency was much cheaper than fair value; we don’t think measures like curbing oil demand or NRI bonds are required. RBI’s open-market operations calendar has come as a bit of a surprise. The point to watch out for is if they have front-loaded OMOs in light of recent money-market turmoil or will these OMOs continue at similar pace for the rest of the fiscal year — Bloomberg