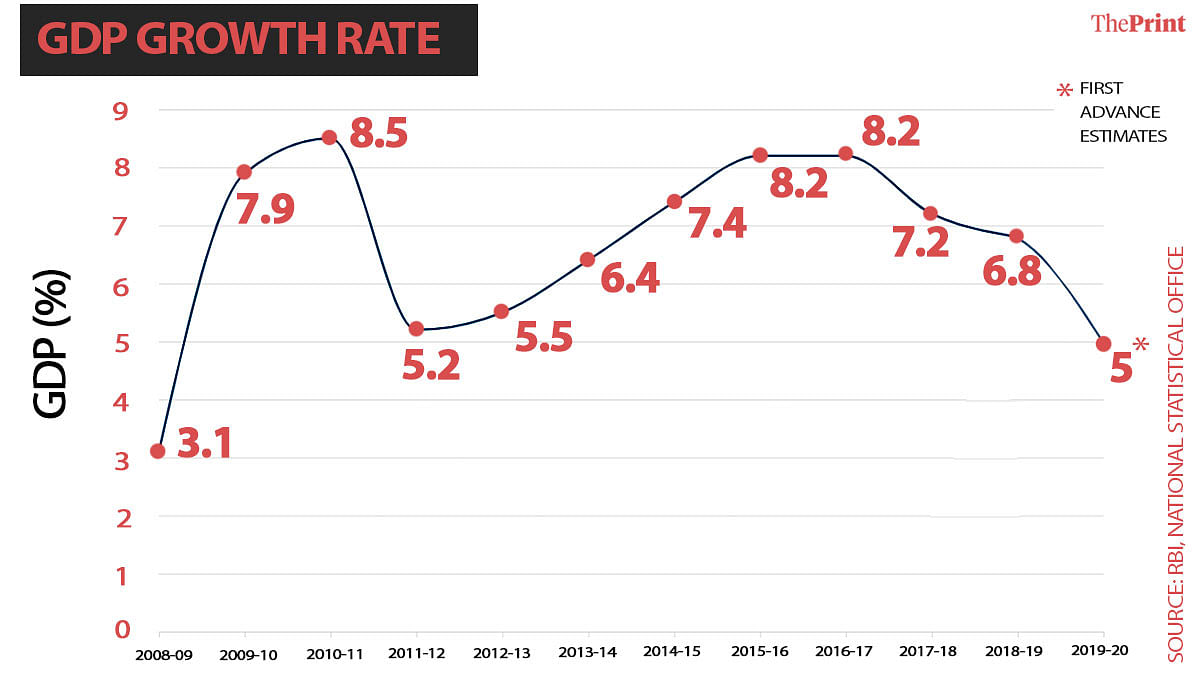

New Delhi: The Indian economy is expected to grow at an 11-year low of 5 per cent in 2019-20, the National Statistical Office (NSO) said Tuesday, indicating the major economic challenge confronting the Narendra Modi government in its second term.

The economy had grown at 6.8 per cent in 2018-19.

Finance Minister Nirmala Sitharaman’s Union Budget, due to be presented next month, is expected to focus on measures to address the third consecutive year of slowdown, led by a fall in investment and consumption.

Also read: India’s shock GDP growth rate is a crisis Modi govt should not waste

Manufacturing, agriculture to grow

Data released by the NSO showed that while manufacturing is expected to grow by 2 per cent, agriculture is expected to grow at 2.8 per cent and electricity, gas and water supply at 5.4 per cent. Gross fixed capital formation — a key measure of investment demand in the economy — is estimated to grow at 1 per cent.

Reflecting the slump in consumption, private final consumption expenditure is estimated to grow at 5.7 per cent as against 8 per cent in 2018-19. Government final consumption expenditure, meanwhile, is estimated to grow at 10.5 per cent as against 9.2 per cent in the previous year — an indication that government spending has helped prop up the economy.

The Reserve Bank of India, in its December monetary policy review, had lowered India’s growth forecast to 5 per cent for the full year, as against its initial forecast of 7.4 per cent for the full year.

This followed a lower-than-anticipated GDP growth in the first two quarters of 2019-20. The Indian economy grew at 5 per cent in the quarter ended June, and at 4.5 per cent in the quarter ended September.

But more worryingly for Sitharaman, the nominal GDP growth — or growth in the economy including the price effect — is estimated at 7.5 per cent to Rs 204 lakh crore. Nominal growth numbers form the basis for estimating tax collections and the fiscal deficit as a percentage of GDP. The 2019-20 budget had estimated India’s nominal GDP at Rs 211 lakh crore, a growth of 12 per cent over the estimated Rs 188 lakh crore in 2018-19.

This means that even without taking into account the fiscal slippage on account of a slowdown in tax collections and a shortfall in disinvestment receipts, India’s fiscal deficit as a percentage of the GDP is expected to be higher than the 3.3 per cent estimated in the budget.

Ratings agencies’ response

Care Ratings, in a note, pointed out that according to the revised base of nominal GDP, the fiscal deficit as a percentage of GDP should come in at 3.44 per cent. Adding the shortfall expected in tax collections, the fiscal deficit could be in the range of 3.92 per cent to 4.13 per cent in 2019-20, it said.

It added that the investment rate is at its lowest since since 2001-02. The share of gross fixed capital formation as a percentage of the GDP has fallen to 28.1 per cent from 29.3 per cent the previous year.

“There is a notable decline in the growth of gross fixed capital formation… which is reflective of subdued investment activity in the economy,” it said.

Aditi Nayar, principal economist at rating agency ICRA, said the various economic indicators point to an improvement in growth in the second half of the fiscal.

“Moreover, the YoY rise in rabi sowing amid healthy groundwater and reservoir levels, bodes well for agricultural growth and rural sentiment, particularly in the ongoing quarter. However, the momentum of spending by the central government dipped in October-November 2019, and we are apprehensive that revenue concerns may necessitate an expenditure squeeze by the central and state governments in the ongoing quarter, which has emerged as a key risk to the pace of economic growth,” Nayar said.

Also read: ‘Hard to work with govt in which you’ve lost faith’ — JNU professor quits statistics panel

Mandir Banao, Kumbh Mela Karo, kaun .Fiker karega economy ke bare mein, Hindutva altoo faltoo per time waste Karo, Dunia gumo. Kaun Economy Jaien Baad mein.

Socialist Modi murdabad.

The 5% GDP expected for 2019-2020 still seems bluffing after the turmoil in the Industrial output and lowest demand in the consumer sector. Political hip-hop is worsening the scenario for a fair foreign investment necessary to boost the moral of people trusting to bring the dying economy to its feets. The arguments regarding revision of GST ratio is a blank and unanswered call and arrogant and naive behavior is creating more trouble to the business class. Under no circumstances the Govt.’s adamant approach intends to look into the recommendation urgently needs to be implemented for a break in the dying economy. We are still a strong manufacturing sector and hence can climb back to start afresh leaving behind the bad debts incurred during this recession. Unlike the economies of Latin American countries who rely hugely on the U.S. mood, India has been chased earlier by the top investors in the world who can again review a soft line in investment. Moreover the exports needs to be focused narrowing the deficit against the imports but the looming conflicts in the middle east and many African nations happens to be a huge obstacle. Unless the Govt. listens to the demands of the honest tax payers and respects them, the few good boys in the corporates are not enough for a viable and long terms solution.

Surjit Bhalla, Sunil Alagh, one has lost count of all the false prophets of a new dawn. Unarguably the worst mentoring of the economy since 1947. What hurts infinitely more is that this has been done at a time when the external environment was so supportive. Sheer genius.