The Modi government suspects the Rs 2,000 note is being used for hoarding, tax evasion and money laundering.

New Delhi: India has stopped printing Rs 2,000 notes in a bid to slowly reduce their circulation, a highly placed government source told ThePrint.

The cut in circulation does not mean the Rs 2,000 notes will become invalid. In all likelihood, the denomination will be gradually phased out.

The decision comes on the back of suspicion in the Modi government that the high-denomination banknote was being used for hoarding, tax evasion and money laundering.

The RBI, India’s central bank and currency-issuing agency, did not respond to an email from ThePrint seeking comment. This report will be updated when it responds.

The Rs 2,000 note was introduced in November 2016, after the government demonetised Rs 1,000 and Rs 500 denominations as part of an exercise pitched as a crackdown on black money. At that time, to counter the massive cash shortage, the government flooded the country with new Rs 2,000 notes.

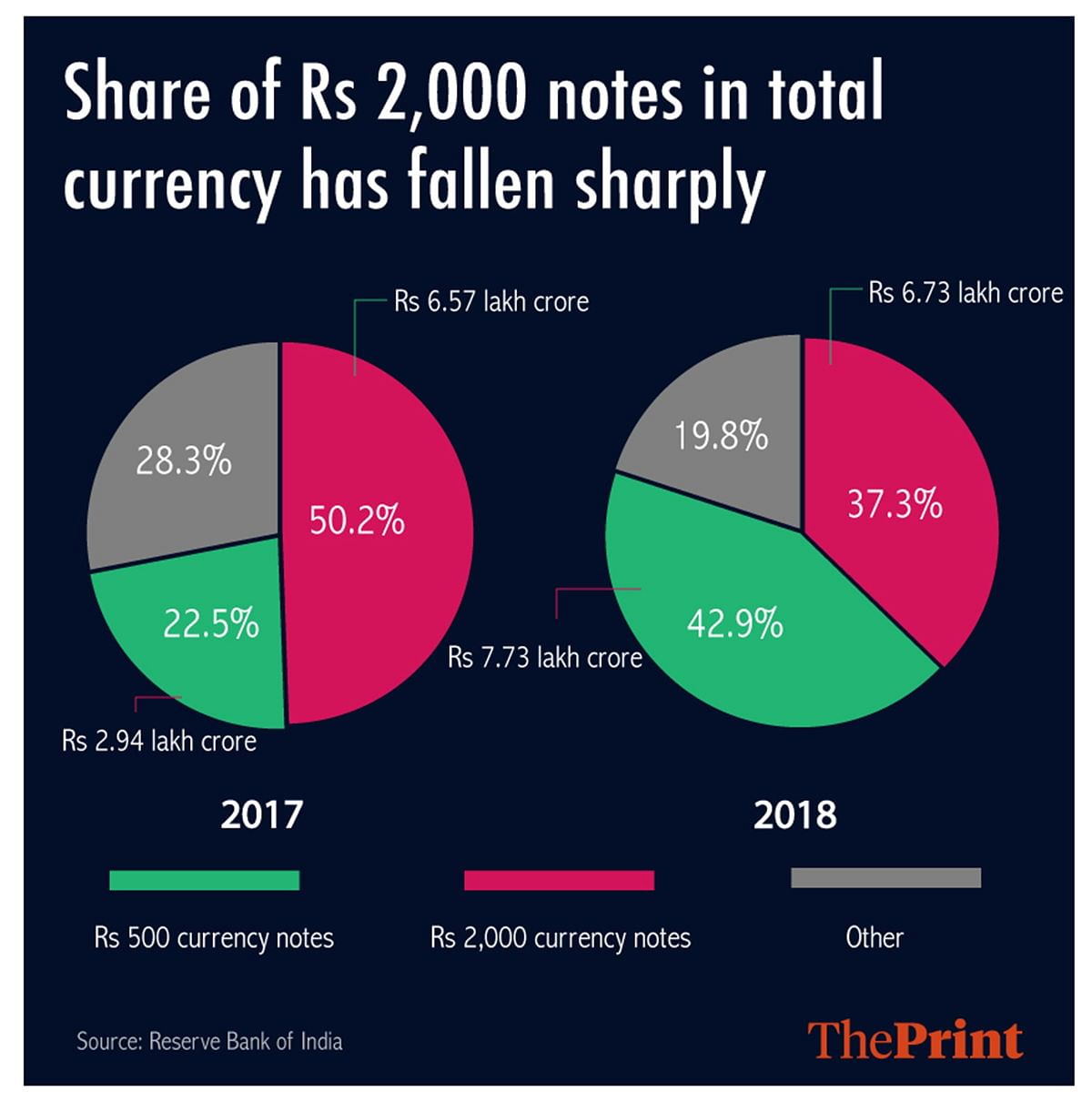

As of March 2018, the total value of the currency in circulation was Rs 18.03 lakh crore, of which Rs 6.73 lakh crore, or 37 per cent, was in Rs 2,000 notes, and Rs 7.73 lakh crore, approximately 43 per cent, in Rs 500 notes. The remaining was in the lower denominations.

Also read: This is what global experts have found studying demonetisation, while Modi looks away

A criticised move

When the Rs 2,000 note was introduced, the Narendra Modi government was criticised for bringing out a note of such a high denomination considering it had cancelled the Rs 1,000 note.

Opposition parties had argued that the Rs 2,000 note would further help money launderers and tax evaders, and backfire on one of the government’s stated aims for demonetisation — checking tax evasion and money laundering.

These fears seemed to have come true last April when many Indian cities reported a massive cash shortage. The government suspected cash hoarding ahead of state elections, as well as stocking of money by people in the aftermath of the PNB-Nirav Modi bank fraud.

The income tax department also reported massive seizures of Rs 2,000 notes during this period.

The critics included bankers, with Uday Kotak, the managing director of Kotak Mahindra Bank, questioning the government’s move to bring in Rs 2,000 notes while phasing out Rs 1,000 notes.

Also read: Demonetisation hit growth by 2% points, says paper by Gita Gopinath & 3 other experts

Falling share in currency

The squeeze in the circulation of the Rs 2,000 notes started some time back.

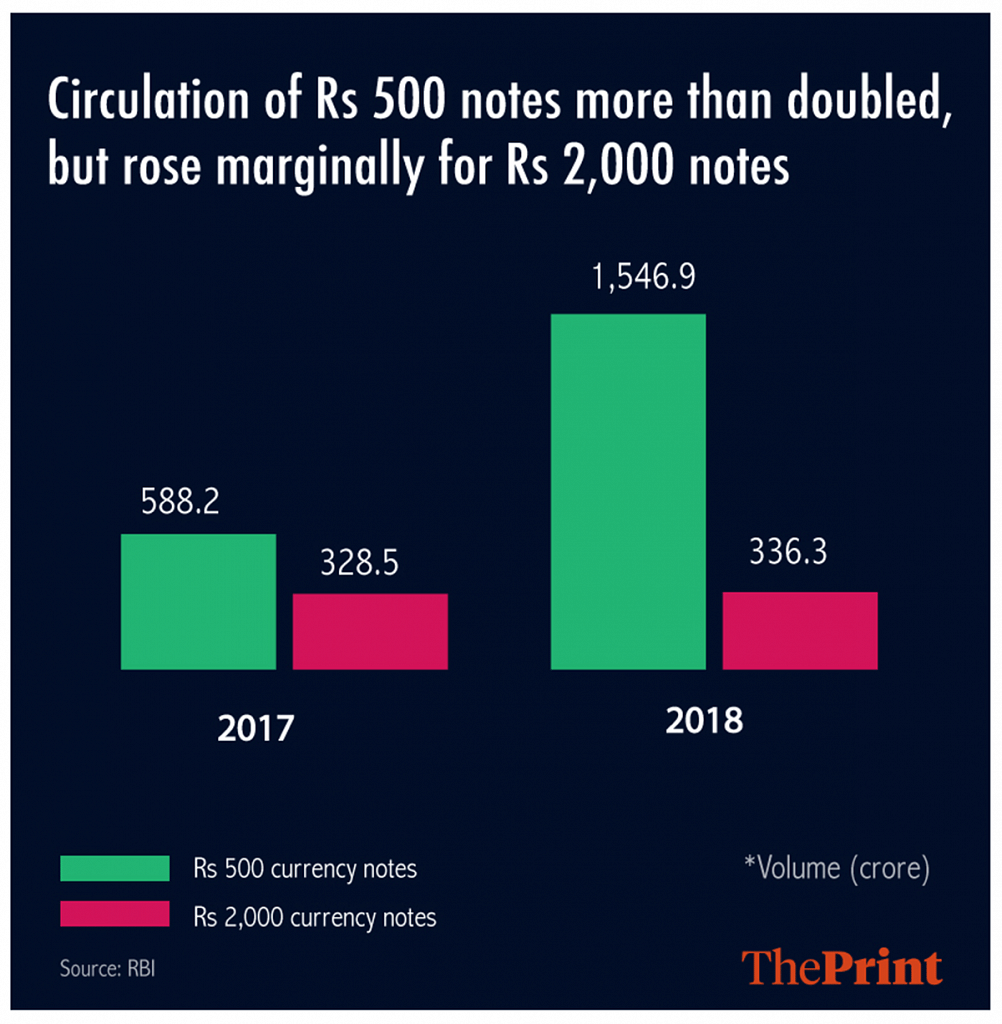

The RBI’s annual report, released in August 2018, showed that only 7.8 crore notes of the Rs 2,000 denomination were added in 2017-18, taking the total number of bills in circulation to 336.3 crore as of March 2018.

In 2016-17, 328.5 crore Rs 2,000 notes were in circulation.

The share of the Rs 2,000 notes in the total currency in circulation has come down as well: In March 2018, it was recorded at 37.3 per cent, a fall of nearly 13 percentage points from 50.2 per cent as of March 2017.

In contrast, the printing and circulation of the new Rs 500 note has been stepped up. India added 958.7 crore Rs 500 notes in 2017-18, with 588.2 crore notes in circulation the previous year.

The share of the Rs 500 notes in the total currency in circulation has increased too, from 22.5 per cent in March 2017 to 42.9 per cent in March 2018.

UK has fifty pound notes as max, and USA has 100 dollar bills as max. India should not have anything more than 500 notes.

I think anyone who has even the basic knowledge of economics that currency denomination are printed against the valuation of gold earned by the RBI through valuation/devaluation of the nation’s stocks in the international stock market. Now if the nation’s stock is facing recession in global market then its pretty obvious the RBI will decelerate printing of hard currencies like Rs.2000/- & etc. It has nothing to do with “Shock Launch” as being projected by “The Print”.

Why did you introduced and now why are you facing it out ? Jumlebaj Modi ji who will bear the cost ? People of India will never forgive you Modi ji.

The hoarded comes back and thats the smart idea

Since last about four and a half years this Govt can’t fathom out what the right hand is doing vis a vis the left hand ! It is totally at sea against

all the controversies and actions what with a chai wala as Prime Minister and an advocate by profession as a finance minister !!!

And coincidently if any criticism is going around against this Govt instead of the Prime Minister to reply to the queries and questions this Finance minister has all the answers for anything under the sun !!!

People truly and totally confused what with the other parties as they are. Mother India desperately in need for some salvation from these power hungry politicians.

it is better to agree with the the decision the modi takes…..he will do a lot ..a lot for india. so plzz give him more and more time as the Congress had taken …he will do better.i bless to god for his long and very long duration of his post.

Can’t trust which news is fake or authentic these days.

The decision of printing 2000 rupee bill were also stupidity itself. Now if this news is correct then it’s hence proved

Creating a scare to make people go against the government. If any denomination note printing is stopped the sky is not going to collapse, the government will have other notes or arrangements.

A very stupid article. Even today my ATM dispensed only 2000 rupee note.

Your reply seriously elicits that how ignorant and a right one can be. My kind Sir, when notes get printed it doesn’t come straightaway to your ATM, I hope you know that every bank maintains a chest and everyday RBI doesn’t fill the chest of every bank with new notes. There are some SOP’s and protocols, please browse for them on the internet before making such an ignominious statement. The phasing out process is meticulously carried out, So, that no shocks to market and to the nation are given. The article should be treated an authenticated one in the light of the reduction in GST collection which is a sign of tax evasion.

Oh man I just laugh at the veracity of your intellect …..

Oh man, I am laughing at the veracity of your intellect.

A very very stupid comment? Are all bhakts like this ?

It is indeed a travesty that this note was even introduced in the first place. Higher denomination notes should be removed from circulation, and businesses Shokld now be rated on the basis of how much of their business (both receipts and payments) they make using electronic methods. The government has made it easy to transfer money to one another using UPI, QR codes and other payment methods like PayTM, cards have also been used increasingly by people. In such a case, why is cash required in most major cities? Opening bank accounts became easier as well during the NDA regime. All these things point to the fact that with smartphone penetration and other solutions available, people should learn to rely on digital money for their transactions.

Mohammed Bin Tuglaq and his Tughalqi Aadesh ? Andher Nagri Chaupat Raja !

Chasing a vain shadow. More enterprising Indians will join Russian grandmothers in hoarding $ 100 bills.