Nomura manager Takashi Mishima says the market has already priced in much of the potential rate hikes.

After seeing India’s benchmark bond yields rise more than 40 basis points this year, Nomura Asset Management Co.’s Takashi Mishima is seeing a “good entry point” into the market now.

“India stands out by far in emerging markets,” Mishima, senior fund manager at the fixed-income investment department of Nomura Asset, which oversaw the equivalent of $493 billion as of 31 March, said in an interview in Tokyo. “The market has already priced in much of the potential rate increases and that would limit any yield gains from here.”

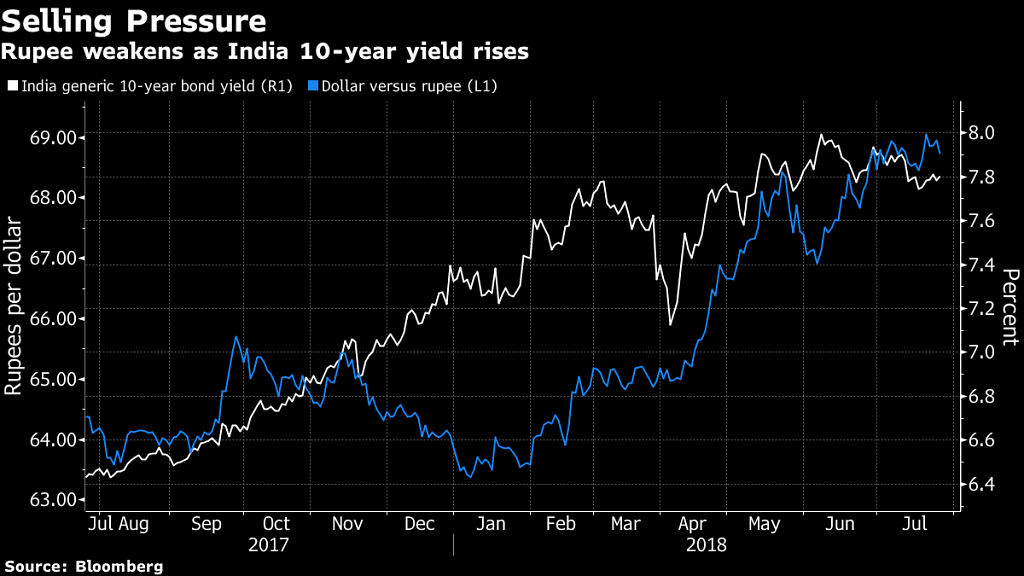

India’s benchmark 10-year sovereign yield has climbed to the highest level since 2014 last month amid concerns of rising oil prices fanning inflation and leading to a tighter monetary policy by the central bank. Foreign investors have withdrawn more than $6 billion from rupee debt this year, while the currency has weakened 7 per cent to 68.6650 per dollar, making it the worst performer in Asia.

“It’s unlikely that the rupee will rebound significantly, but it’s also unlikely to fall drastically given the support that the central bank provides through intervention,” Mishima said. “We expect the authority to defend around 70 per dollar-level for the time being.”

The spread between the yields of AAA 10-year corporate bonds and similar-maturity sovereign debt widened about five times from its 13-year low in January, according to data compiled by Bloomberg.

Nomura’s two India bond funds, which had combined assets of the equivalent of $1.9 billion as of 24 July, also invest in dollar-denominated Indian corporate debt. The fund owns notes issued by companies that are linked to the government and have longer duration, such as 10-year securities of Oil India Ltd and Hindustan Petroleum Corp., according to Mishima.

Here’s what Mishima had to say about the economy and risks:

“The Reserve Bank of India may lift the benchmark rate once or twice more this year, with a 25-basis points move possible as early as August, after it hiked it by as much in June to 6.25 per cent. He forecasts inflation to peak in July-August because of the base effect and drop toward the middle of the central bank’s target range. Risks for India bonds may be a significant deterioration in the nation’s current-account balance, especially should oil prices rise above $100 per barrel, or if the government takes some drastic steps that would threaten its efforts to improve fiscal balance. If next year’s election result starts to look uncertain, that may cause volatility in the market.” –Bloomberg