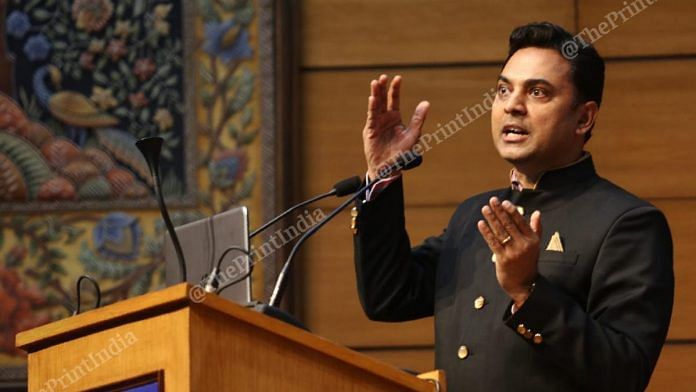

New Delhi: The Indian economy’s performance will pick up in the second half of the fiscal, and the International Monetary Fund (IMF)’s projection of a 1.9 per cent growth for India in 2020-21 may be a reasonable estimate, Chief Economic Advisor Krishnamurthy Subramanian said Monday.

In a conversation with ThePrint’s Editor-in-chief Shekhar Gupta, Subramanian said, “There will be an adverse impact on the Indian economy due to Covid-19. The IMF estimate of 1.9 per cent growth (in 2020-21) is a reasonable estimate.”

He added, “The growth in the April-June quarter will be badly hit. The next quarter will be better and economic performance should pick up in the second half of the year.”

Subramanian pointed out that consumers who have postponed their discretionary spending, like buying homes or cars, are likely to resume purchases once the situation improves.

The CEA also said that the Narendra Modi government is looking at attracting foreign investors to purchase locally issued government debt to finance its fiscal deficit and the much-anticipated Covid-19 fiscal stimulus package.

A stimulus package for micro, small and medium enterprises and start-ups is likely to be announced soon, he said.

The government is considering a reduction in customs duties on intermediary products like raw materials to encourage ‘Make in India’ at a time when global companies are looking to move their production base out of China in the aftermath of the Covid-19 pandemic, said Subramanian.

The Modi government and the Reserve Bank of India (RBI) have taken a series of steps to protect the economy from the Covid-19 fallout. While the government announced a Rs 1.7-lakh crore package of cash transfers and free foodgrains last month, the RBI has sharply cut policy rates, allowed a three-month loan moratorium and provided liquidity to stressed sectors like non-banking finance companies.

The government is now working on a second stimulus package looking to protect the worst hit sectors, and an announcement is expected to be made soon.

Also read: Govt revises FDI policy over fears of Chinese takeover of Indian firms amid Covid-19 crisis

‘Money does not grow on trees’

The chief economic advisor to Modi government said unlike the 2013 taper tantrum, the fiscal deficit is the only macroeconomic variable that the government needs to be concerned about for now.

India’s current account deficit is likely to remain at 1 per cent of GDP and inflation at around 4 per cent due to low oil prices and subdued domestic demand, he said.

Subramanian said the stimulus package has to take into account the fiscal constraints. “We have to take a decision that is correct for India and not look at what other countries are doing,” he said.

“Money does not grow on trees and India has to take into account that it has a low tax base,” he added.

Besides market borrowings, the government is eyeing a chunk of the $4 trillion investment made by foreign investors in the sovereign bond index, Subramanian said.

“We have taken steps that even India can become a part of it. Even if India gets a 1.5-2 per cent weightage, it means an inflow of $60-80 billion. All of this may not come this year but even if a small portion of the amount comes in, it will help in funding the Covid-19 package,” he said.

Also read: Why it’s still expensive for states to borrow money when Covid-19 has shrunk interest rates