Mumbai: Two major Indian lenders slumped in the bond market after their credit ratings were cut to junk by Fitch Ratings, in the latest sign of concerns about the nation’s banks that are battling the world’s worst bad-loan ratio.

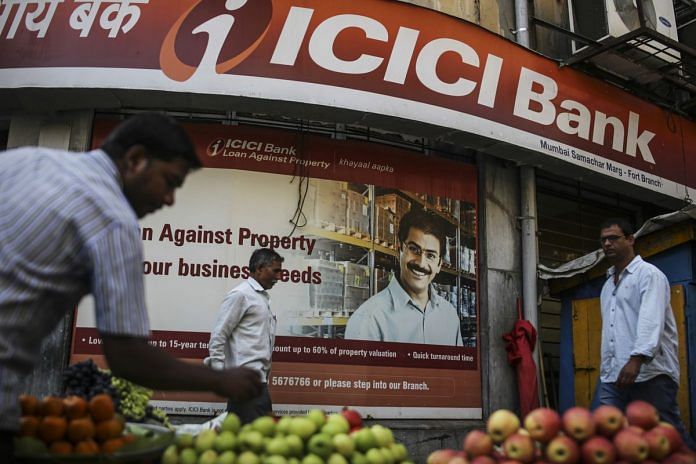

Fitch lowered its long-term issuer default ratings on ICICI Bank Ltd. and Axis Bank Ltd. to BB+ from BBB- late on Monday. Certain dollar bonds from ICICI slumped the most in more than a year, while ones from Axis Bank fell the most in over six months on Tuesday.

“We expect the performance of India’s banking sector to be below average over the next one to two years despite our expectations of high economic growth and improving business prospects,” Fitch said in a statement Monday. “The sector is still struggling with poor asset quality and weak core capitalization.”

Also read: Somebody should send Axis Bank’s board a ‘thank you’ note

What Happened

ICICI Bank’s 3.25% notes due 2022 fell 0.5 cent, the most in over a year, to 99.7 cents on the dollar, according to data compiled by Bloomberg. Axis Bank’s 3.25% 2020s dropped 0.2 cent, the most in over six months, to 100. Fitch said that the performance of Indian banks has largely bottomed out but the sector is still addressing poor asset quality and weak core capitalization. The ratings company said that ICICI’s key financial indicators are generally weaker than those of banks rated higher. ICICI Bank and Axis Bank have investment-grade ratings from other credit assessors.

Analysis

Nomura sees Fitch’s move as “harsh and backward-looking” as it cut the scores at a time when both these banks have reported a decline in gross non-performing assets in their FY19 financial results. “We agree that the operating environment for Indian banks will remain challenging, notwithstanding the recent positive election outcome which saw PM Narendra Modi return to power with an increased majority, which along with relatively rich valuations, is why we continue to advocate an Underweight positioning in Indian banks’ seniors,” Nomura desk analyst Nicholas Yap says in a note. A $190 billion pile of stressed debt along with eroding capital buffers is constraining lenders ability to navigate the “challenging but competitive operating environment,” Fitch said. “The timing of the downgrades is surprising and I doubt very much that Moody’s and S&P will follow Fitch,” said Owen Gallimore, head of credit strategy at Australia & New Zealand Banking Group. The macro-economic backdrop in India is weak, but after Modi’s re-election, “investors have confidence of monetary and fiscal largesse, which should benefit the banks,” Gallimore added.

Also read: ICICI Board must answer for the Chanda Kochhar scandal

Think of a train driving straight over a cliff, filmed in slow motion as it falls into the seas below. That is where the Indian economy now is. Then we have wise columnists like Swaminathan Aiyar saying that if so many rural votes were cast in favour, there could not possibly be agrarian distress.