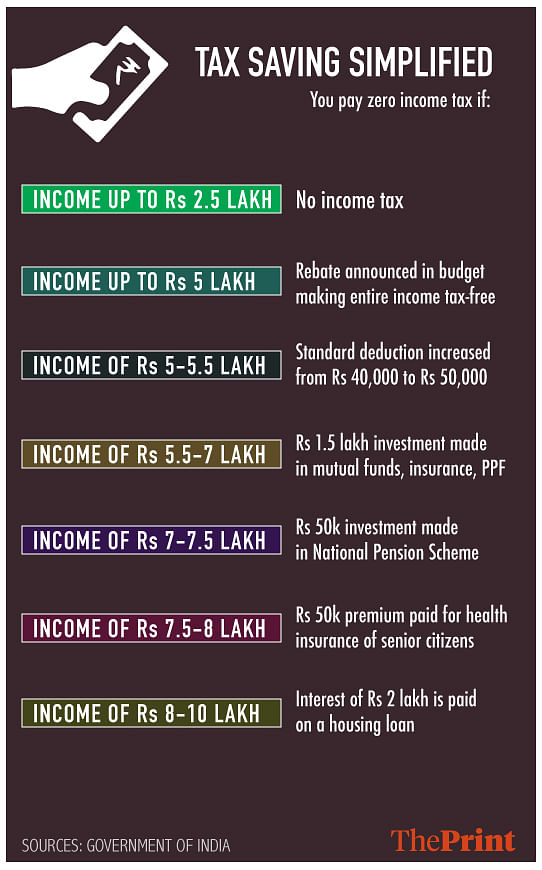

After today’s interim budget announcement, a person earning upto Rs 10 lakh can pay zero income tax with smart financial management.

New Delhi: In a relief to middle-class taxpayers, Finance Minister Piyush Goyal announced full tax rebate for income up to Rs 5 lakh per annum. Those earning upto Rs 6,50,000 will not need to pay tax if they invest in specific schemes such as the Public Provident Fund and prescribed equities.

This could benefit as many as 30 million taxpayers, the minister said, adding that those earning more will be taxed at the prevailing rates.

These sops, combined with the other goodies announced, mean that anyone earning up to Rs 10 lakh can walk away with Rs 0 tax payable if they just plan smartly. Here’s how:

And, for a family of three comprising husband, wife and a senior citizen, this may result in almost no tax till a combined income of Rs 25 lakh per year.

Economists expect the measure to free up income in the hands of the people, providing a major consumption boost to the economy.

Also read: Winners and Losers: Piyush Goyal’s 2019 interim budget