Too many licences, too little spectrum, high taxes and supply-constrained airwave auctions makes India’s telecom market very expensive to operate in.

Making money in a booming Indian mobile-phone market that soared from fewer than 2 million users to more than a billion in less than two decades might have seemed like a no-brainer. Now it’s more like a nightmare with losses for overseas companies rising to at least $23 billion.

“The promise of a market with over one billion potential users is very attractive,” Chris Lane, a Hong Kong-based analyst at Sanford C. Bernstein, said by email. “Too many licences, too little spectrum, high taxes and supply-constrained airwave auctions has made this a very expensive market to operate in.”

The $23 billion lost includes impairment charges and losses reported in company filings of global majors from London-based Vodafone Group Plc to Japan’s NTT Docomo Inc. — all of whom have exited or suffered as hyper competition has hurt the earnings of even the market leader Bharti Airtel Ltd. Expensive spectrum auctions and cancellation of telecom licenses in the wake of a graft probe made it even harder for the companies that piled into a market that as of 2015 included 12 competing operators.

Investor Losses/Write-Offs Status Vodafone Group $8.7 billion Merging with Idea Cellular Maxis Communications $7 billion Filed for bankruptcy Telenor $4.1 billion Sold to Bharti Airtel, exited NTT Docomo $1.3 billion Litigated, sold stake back to Tata group, exited Etisalat $829 million Exited AFK Sistema $695 million Merged with Reliance Communications Axiata Group Bhd $356 million Took write-offs, still holding 10.6 per cent in Idea

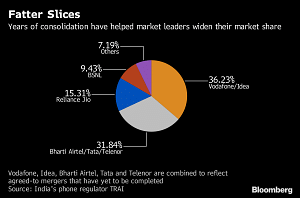

The entry of India’s richest man Mukesh Ambani’s Reliance Jio Infocomm Ltd. in 2016 has proven to be a turning point in consolidation for the market. The upstart stormed in with free voice services for life and initially free data services to lure subscribers, prompting smaller rivals to merge or quit the market altogether.

“I suspect most of these would have eventually failed or been consolidated,” said Lane. “Jio only expedited the process.” –Bloomberg