New Delhi: The Income Tax department has come up with a series of proposals to massively overhaul its tax dispute system, which if implemented could make the country more taxpayer-friendly, reduce litigation costs and help in faster tax collection.

Chief among the proposals is one in which the IT department is considering giving taxpayers the option to take up mediation before the finalisation of the assessment order. This, the department hopes will reduce the litigation that it is entangled in.

The proposals have been formulated by an internal committee of the department, which was set up in February. The committee has called for making the tax dispute management system comparable to international litigation standards.

To tackle the department’s monumental litigation problem, the committee has envisaged a two-step process — in the first step, the tax department will strive to produce error-free and less discretionary assessment orders through vetting by senior tax officials so as to minimise disputes. In the next stage, the draft assessment order prepared by the assessing officer will be shared with the taxpayer. At this stage, the taxpayer can opt for mediation and strive to arrive at a mutually agreeable assessment order.

“Mediation is a good method to manage litigation and this method is followed in many countries,” said a senior income tax department official, who did not wish to be identified.

“There is an alternate dispute resolution mechanism in international taxation and we propose to now extend it to domestic taxpayers. It will bring down the cost of litigation and also enhance tax collections,” the official said.

“The mediators could be neutral parties like retired judges and tax officials or lawyers,” he added.

The recommendations of the committee, recognising that recovery becomes difficult after protracted litigation, are aimed at realising tax revenue, locked up in department appeal, at an early date. It will also help in checking overzealous assessment officers. Assessing officers, under pressure to meet tax targets, have been often criticised by courts for their aggressive orders.

The proposals have received in-principle approval from the Central Board of Direct Taxes (CBDT) and are awaiting the nod of the finance ministry, the official said.

Also read: Modi govt unlikely to meet fiscal deficit target as tax collections fall short

Around Rs 10 lakh crore stuck in litigation

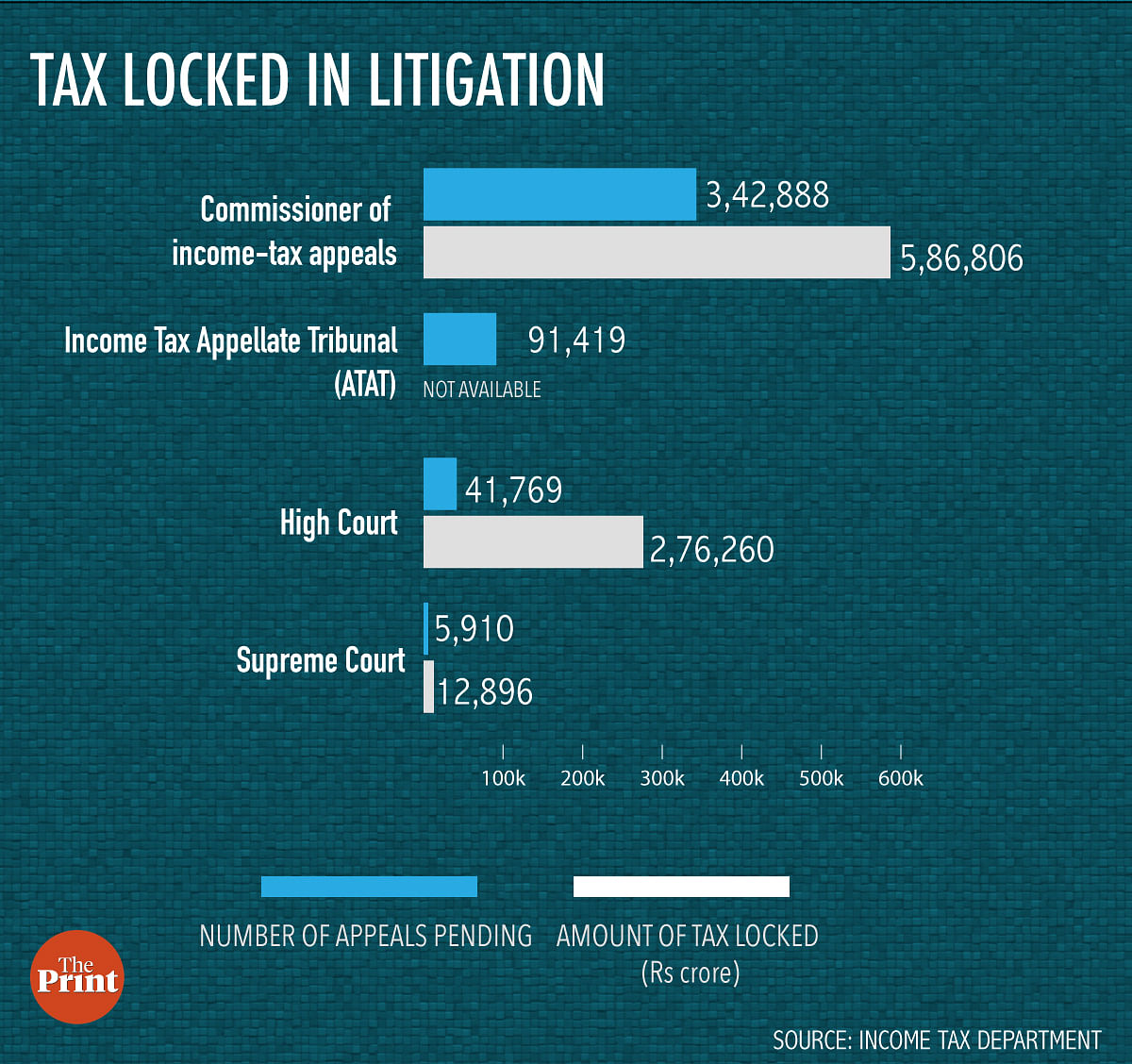

Data available with the IT department shows that the total tax effect of the cases stuck in various judicial and quasi-judicial bodies is around Rs 10 lakh crore. A majority of these cases are pending with the commissioner of income tax (appeals), the first stage of appeal available to taxpayers. (see box)

The CBDT had attempted to tackle its litigation problem even earlier. It had set up at least two internal committees — one in 2014 and another in 2016 — to suggest ways of tackling the huge number of tax disputes as well as reduce the resolution time taken for solving the disputes.

Last year, the tax department had also increased the threshold for filing appeals by the revenue department in the Supreme Court, high courts and tribunals. It was increased to Rs 1 crore from Rs 25 lakh for the Supreme Court, Rs 50 lakh from Rs 20 lakh for high courts and Rs 20 lakh from Rs 10 lakh for income tax appellate tribunals. The department had estimated that the move would unlock Rs 5,600 crore of tax from litigation.

“The government is changing the narrative of the tax department from ‘tax collection’ to progressive dialogue through mediation. This is a quantum leap in governance for India since the Vodafone case and I hope it sends out a positive message to foreign investors,” said Kritika Krishnamurthy, director of the public policy think-tank Bridge Mediation & Consulting.

“At the same time, an objective approach to solving this problem is possible only if the government forms an independent committee consisting of not just the tax department but also proactive judicial members with tax experience.”

Also read: I-T dept acts irrespective of political affiliations, finance ministry tells EC