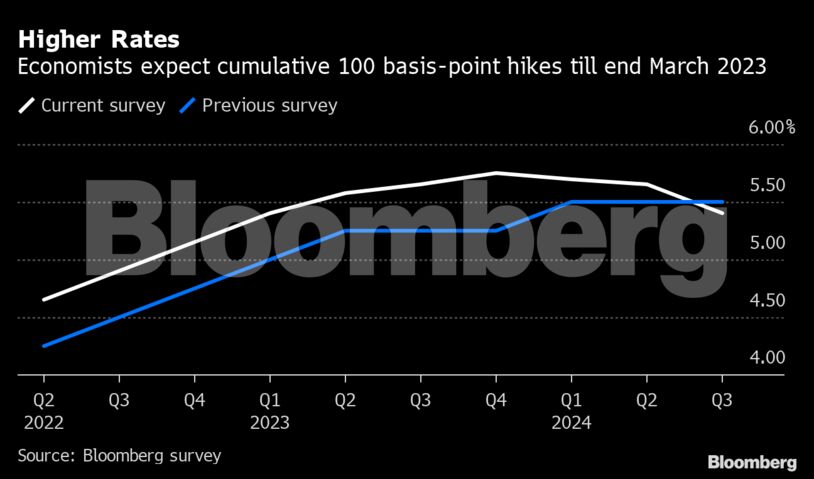

Hong Kong: Economists see the Reserve Bank of India following up its off-cycle interest rate increase with another 100 basis points of moves in the current financial year ending March, the latest Bloomberg survey shows.

The benchmark repurchase rate is expected to climb to 5.40% in four quarter-point moves during the period, according to the median estimate in the survey. The analysts see the rate further rising to 5.75% through December 2023, or 50 basis points higher than previously expected.

Cash reserve ratio, the amount of deposits that lenders are required to park with the central bank as reserves, will likely hold at 4.5% until end-September before it is hiked once more to 4.75% in the final quarter of this year.

“There is a possibility of 25-35 basis-point hike in policy rates in FY 2023. However, its timing will be data dependent,” said Devendra Pant, chief economist at India Ratings and Research Pvt, a local unit of Fitch Ratings Ltd. “Commodity prices are unlikely to come down at least until the war between Ukraine and Russia is over.”

The Reserve Bank of India raised key interest rates and moved to drain billions from the banking system in a surprise move Wednesday to tame inflation. The decision shocked markets and pushed the benchmark 10-year bond yield to its highest level in three years.

The same poll showed that economists kept their gross domestic product forecasts for January-March quarter at 3.9%, but raised the outlook by 1 full percentage point to 14.5% growth in the subsequent quarter. GDP and gross value-added forecasts for the full-year ended March were lowered slightly to 8.7% and 8%, respectively.–Bloomberg

Also read: RBI raises repo rate to 4.4% on elevated inflation outlook, governor cites ‘global price shocks’