Actual earnings that reinforce forecasts will help justify hope among analysts about market prospects despite headwinds.

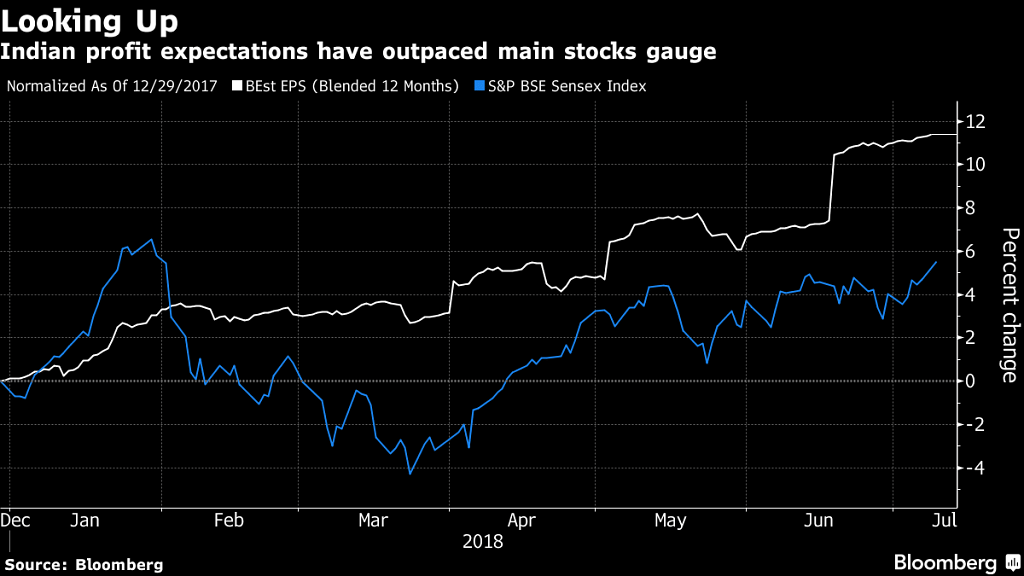

Mumbai: At a time when emerging markets have been roughed up by trade tensions between the world’s biggest economies, the earnings picture in India is improving.

That’s the message from Morgan Stanley as it expects companies in the S&P BSE Sensex to report a 23 per cent increase in net income in the June quarter from a year earlier, with more than three quarters of the 30 members likely to contribute positively to aggregate profits. That would mark a third straight quarter of double-digit growth, according to data compiled by Bloomberg.

“Results should show some recovery and broadening of earnings growth,” Morgan Stanley analysts Sheela Rathi and Ridham Desai said in a 5 July report.

There’s more. Research firms from Deutsche Bank AG to Crisil Ltd are also bullish.

“Besides the supportive base-effect, there is also a strong revenue boost owing to higher global commodity prices,” Bijay Kumar, an analyst at Deutsche Bank AG wrote in a note. He expects earnings for stocks on the Nifty 50 Index to rise by 20 percent.

Thanks to a robust recovery from the national sales tax introduced last July and higher metal prices, revenue growth in the period may reach a three-year high of 13 per cent, according to Crisil Ltd. Actual earnings that reinforce analysts’ forecasts will help justify optimism among analysts about the $2.1 trillion market’s prospects despite headwinds caused by high oil prices, a weak rupee and hardening interest rates.

India’s economic growth has picked up in recent months, prompting the central bank to raise its outlook for gross domestic product growth to 7.4 per cent in the year that started 1 April from 6.6 per cent in the previous year. The world’s fastest-growing big economy is relatively shielded from trade risks due to its large domestic market, which has added to the allure of its stocks.

The Sensex jumped 7.5 per cent in the June quarter in local-currency terms, the top performer among developing nations. That’s as the MSCI Emerging Markets Index slid almost 9 per cent, data compiled by Bloomberg show. The Sensex rose 0.6 per cent to a five-month high at 10:29 am in Mumbai.

Here’s what brokerages and investors expect from the April-June earnings season that kicks off Tuesday with Asia’s largest software exporter Tata Consultancy Services Ltd and private lender IndusInd Bank Ltd scheduled to report.

Commodity-linked sectors, such as steel products and petrochemicals, are expected to continue growing as prices surge. Cement will continue to witness high volume-driven growth, led by demand from the affordable homes, according to Crisil’s analysis of 350 companies.

Sanctum Wealth Management said it expects consumer and private-sector financial companies to maintain leadership, technology companies will demonstrate positive momentum, according to Chief Investment Officer Sunil Sharma. “There are signs of bottoming out in healthcare but one needs to closely watch the numbers. Metals and power sector are likely to disappoint while automakers should show strong numbers on pass-thru of prices to customers,” he said.

Deutsche Bank expects consumer, energy and healthcare sectors to report relatively strong earnings growth; forecasts over 20 per cent increase in profit for automakers Mahindra & Mahindra, Maruti Suzuki and Bajaj Auto.

Lower base, weaker rupee will help pharmaceutical companies, while crude oil prices will drive earnings at Oil & Natural Gas Corp. Ltd and Bharat Petroleum Corp. Ltd. Morgan Stanley expects Tata Motors, Coal India, ONGC and Sun Pharmaceutical to be biggest positive contributors; Lenders — State Bank of India, Axis Bank and ICICI Bank — will likely be the major drags on growth. –Bloomberg