To ensure equity between the states, poorer states should receive a greater share of union tax revenues as compared to better off states.

For the first time perhaps in living memory, there’s a spirited debate about the terms of reference of the finance commission – a body that most Indians, even the educated elite, have not even heard about, let alone care too much about.

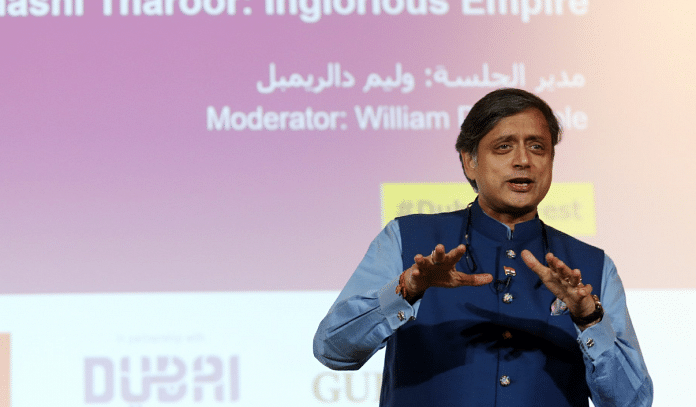

Shashi Tharoor’s piece, ‘Modi govt opens a Pandora’s Box: States can lose political clout if they develop well’, is an important intervention in this debate, come as it does from a sitting member of Parliament from a national party. His piece is, however, built on four myths about the Centre-state relationship. If not debunked, it could vitiate the discourse. This piece is a response to the four stated (and one unstated) myths that form the central part of Tharoor’s piece.

Myth 1: The finance commission (FC) is being asked to use 2011 data for the first time

While the 15th FC’s terms of reference (ToR) are the first to explicitly state it thus, it won’t be the first time the body has been asked to use 2011 census data in making its recommendations. The ToR of the 14th FC also required it to “take into account demographic changes that have taken place subsequent to 1971”. This meant that the 14th FC gave the 2011 population estimate a weightage of 10 per cent as “demographic change” in determining the shares of states in the divisible pool of Union tax revenues. Seen in that perspective, the 15th FC only carries forward a previous (necessary) move to update the population statistics in allocating Union revenues among the states.

Myth 2: The south is “subsidising” the north

Tharoor references Karnataka chief minister Siddaramaiah’s Facebook post outlining figures that suggest southern states receive less by way of Union tax revenues than those like Uttar Pradesh, even though they “contribute” more. This isn’t the first time this comparison is being made and, while the numbers are correct, it must be pointed out that this sort of comparison is misleading. Union taxation applies on a deeming fiction that if a return is filed in a state, then tax is attributable to that state. It is impossible to segregate an individual tax return on the basis of the source of income. Merely because an entity located in Mumbai files tax returns with the local office, it does not mean that, as a matter of fact, all the tax revenue is only attributable to economic activity in Maharashtra. On this ground, if any state has to have a grievance, it must be Delhi, which, by this logic “contributes” Rs. 1,08,882 crore in direct taxes to the Union government and receives nothing from the divisible pool because it is not a “state” as understood constitutionally.

On the other hand, if collection of taxes is correlated closely with contribution, the northeastern states and Jammu & Kashmir would get little by way of a share in the divisible pool of Union taxes.

Myth 3: The ‘cow-belt’ states have comprehensively “failed” to improve their own development indicators, notably female literacy and women empowerment

From the vantage point south of the Vindhyas, it is tempting to see the whole stretch from Rajasthan to Bihar and Jharkhand as one irredeemable black hole of human despair and stagnation. One only needs to compare the human development indices between northern and southern states to see why this might be a justified conclusion. This, however, obscures the very real progress that has been made even in the so-called ‘BIMARU’ states in improving indicators in the last couple of decades.

Female literacy increased by 20.21 percentage points between 2001 and 2011 in Bihar, by 17.34 and 17.04 points, respectively, in Jharkhand and Uttar Pradesh. Of course, the picture is not entirely uniform: in the same period of time, female literacy improved by only 11.04 percentage points in Haryana, 9.73 in Madhya Pradesh, 8.81 in Rajasthan and 8.74 in Chhattisgarh. Much more can be done and needs to be done, but one wonders how cutting off much needed revenue to these states will help “incentivise” investment in female literacy.

Myth 4: Giving north Indian states more money means “incentivising population growth”

The most pernicious myth of all, repeated by Tharoor, is that giving north Indian states a greater share of Union tax revenues is akin to “incentivising population growth”. This is, once again, based on a snapshot of the total fertility rate of women in different states, without taking into account the progress made across states in reducing this in the last decade or so.

According to the latest available data, while total fertility rates (TFRs) in Uttar Pradesh and Bihar are still a relatively high 3.1 and 3.3 respectively, these are an improvement from 2000, when the figures were 4.7 and 4.5, respectively. In all the ‘BIMARU’ states, the TFR has decreased fairly dramatically over the last two decades, and if the trend continues, will fall for the next decade or so. No doubt, decadal population growth is greater in the north Indian states than the south Indian ones, but we must not assume that this will always be the case.

Myth 4.5: Share in Union tax revenues is a “reward” for improving development indices

This isn’t a myth so much as a misconception. There is no basis to contend that a share in Union tax revenues is some sort of a reward for “performance”. In the last few FC recommendations, the single largest factor that determined a state’s share in the Union tax revenue is the “income distance”. This is arrived at by calculating the difference between the per capita GSDP of a state with that of the richest, large state in India (in the 14th FC, it was Haryana). The purpose of this is to ensure equity between the states – poorer states should receive a greater share of Union tax revenues as compared to the ones better off.

If they didn’t, they would never be able to climb out of the poverty trap they’d be confined to.

As necessary as it is to push back against the Hindi-Hindu-Hindustan agenda of the Union government (and one takes no issue with Mr Tharoor on this), it can’t come in the form of an aggrieved sense of entitlement or a misplaced sense of victimhood among the southern states. The better-off states are already less dependent on Union tax revenues than the less well-off states, and increasing inequality within the Indian union cannot possibly be a solution to this problem.

Tharoor is right in pointing out the larger tensions that are likely to bedevil the Indian Union in the years to come, but does not offer a concrete solution to address them. It is beyond the scope of this piece as well to offer a comprehensive one, but, suffice it to say, whatever solution is proposed, it must be an affirmation of the federal and democratic values at the core of the Constitution and an acceptance that “development” does not require compromise on either of these.

Alok Prasanna Kumar is a senior resident fellow at Vidhi Centre for Legal Policy.

Alok’s biggest untruth among many, is that is anywhere near REASONABLE to demand, let alone expect, the South to donate their incomes after 7 decades of subsidy.

Were 70 years of being fed not good enough? Sure, if ya cannot grow in 70, you might well never.

From now on, rely on yourself.

Hey Alok. I hear you head the Bengaluru office.

Go home? Why here? We’re all unreasonable people demanding for our *entitlements* to our hard-earned money? Is it not?

The day isn’t far you may need Visas, and your Bihari values as you espouse in this article, will help us get to that point. Certainly!

Dear God, Alok! You miss the point!

The Union govt. will now have TOTAL control as the indirect taxes which were raised by States will now be via the GST, which is , again, governed by the Union govt. although we have *s0me* representation through the GST council.

But the GST Council, given the voting power the Centre gets and add to it the vote share of the North (owning to its sheer weight of population) can out-vote the South and West and East on nearly anything!

Wake up! 7 decades of our subsidies were enough. No more loot, you may ask, loot — and ya risk the country!

Nope, if you NEED Southern money to grow — you are telling me that you NEED somebody else’s money to prosper. But ya know what? You have NO RIGHT over others’ money.

Leave to live within your own means. If ya now LOOT us, we may well have to have an irrevocable secession.

You people were never really worthy of sharing a nation with to be honest.

Better of states should try to increase there state tax revenue’s by increasing there tax incomes, like municipality taxes, profession tax ( as I know profession tax slab should be increased first via amendment in constitution) Only then they can yeild the profit of better states. Yes it’s not logical to give more to those states which are not performing as they should but if we take off the extra grant they can never come out of misery. Instead of pulling legs we should try to find out the optimal solution to the issue. And as far as writer is concerned you did an amazing research and yes facts can’t always be right but it’s not the time to divide. Cooperation and Unity plzz

This is the most ridiculous and biased article I’ve read on this issue. The authors bias towards the North is evident. So what if Delhi is getting a rough deal? Does that mean the Southern states also should stay quiet and take this? It’s this attitude of “arey padosi ko dekho, vo unpadh hai, toh mai bhi unpadh hu to chalega” is what is the problem with most Indians, especially the North and with that this author as well. I bet I’ll see him still writing articles for this website 10 years down the road instead of growing professionally.

A few remarks in response to the author’

Myth 1- The 14th FC uses both 2011 and 1971 Census data with 10% and 17.5% weights respectively. The 15th FC is expected to move completely to 2011 Census data. Yes, this is not the first time that 2011 data is being used, but the issue this time is that 1971 Census data is being completely discarded.

Myth 2- Agreed, that tax collection data from Chennai or Bengaluru circles is not a correct way to prove the point due to the headquarter effect of corporates being based in the city but working across the country. However there is a common feeling among South Indians that with higher per capita GSDP and higher tax compliance we are in effect “subsidising” the poorer states. We may not have conclusive data to prove this point, but there is no data to disprove the notion either.