Mumbai: India’s consumers are being tested after helping drive the fastest-growing major economy.

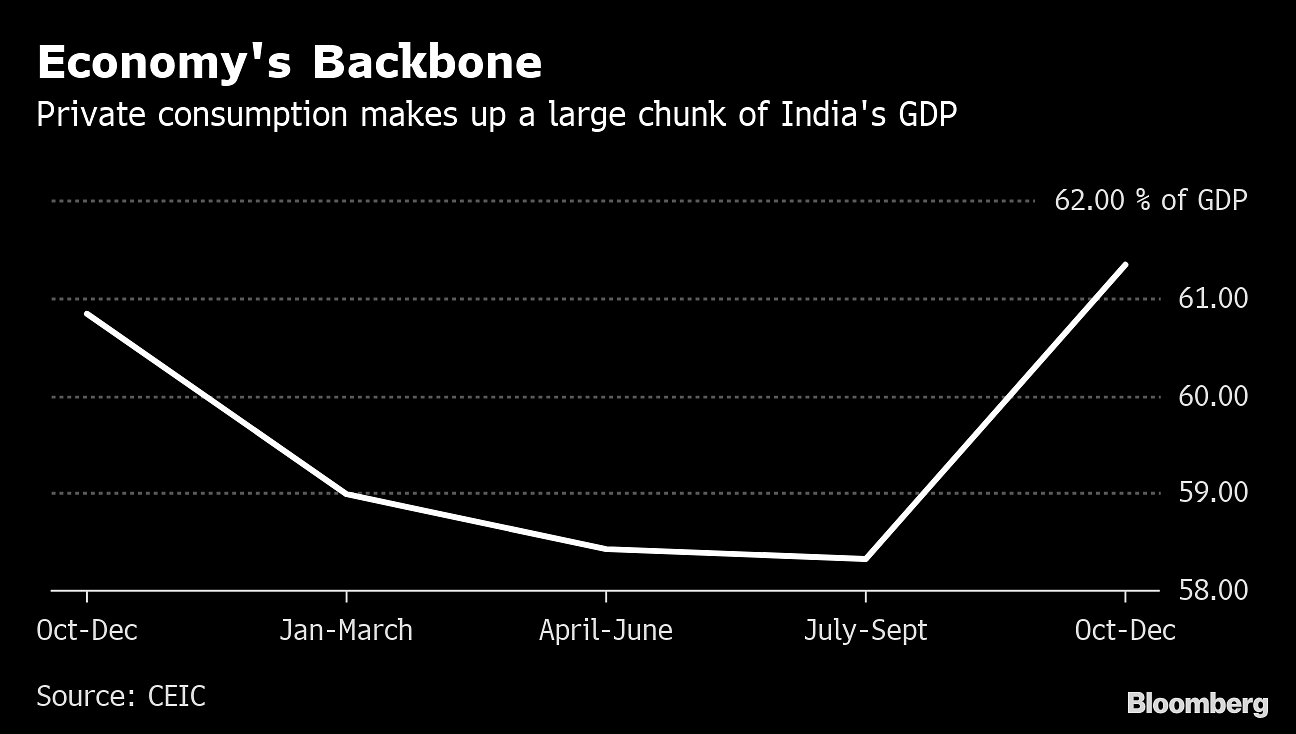

More cautious spending on everything from shampoo to cars and travel threaten to weaken what’s been the backbone of the economy, contributing about three-fifths of gross domestic product. The pullback has acted as a drag on growth, which is predicted to have slowed for a fourth consecutive quarter to 6.5% in the three months to March, the weakest pace since mid-2017 and almost on par with China.

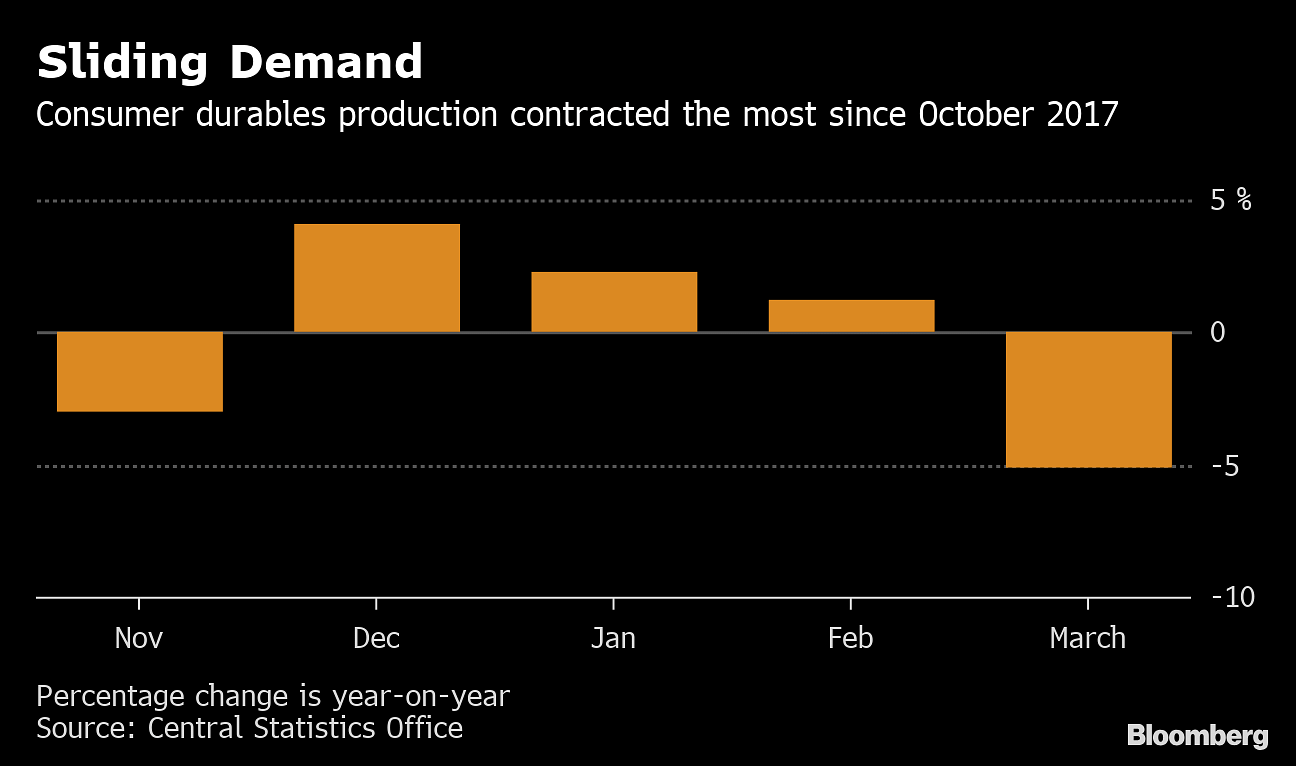

While official GDP numbers for the March quarter are due May 31, high-frequency data for services and manufacturing point to activity slowing with industrial production contracting in March for the first time in nearly two years. Economic sluggishness may persist for a year, according to Credit Suisse Group AG, given high interest rates and stress among India’s state-run and shadow banks. A prolonged slowdown would pose a significant challenge to the next government, which is likely to be in place by late May.

“The slowdown in consumer goods has been sharper than we had earlier expected,” said Suvodeep Rakshit, a Mumbai-based economist at Kotak Institutional Equities Ltd. “Weak monsoons, sustained high interest rates, weak rural demand and reduced space for government expenditure will continue to weigh on GDP growth prospects.”

Kotak Institutional this month lowered its forecast for economic growth for the year through March 2020 to 6.8% from 7.1%, compared with the average estimate of 7.2% in a Bloomberg survey in April. A poll from September, when the credit crunch among shadow banks first emerged, had predicted a 7.5% expansion.

The slowing in demand comes at a time when companies too are holding back investments awaiting the outcome of a general election, posing a double-whammy.

Below is a snapshot of key sectors:

Consumer Goods

The bellwether consumer goods sector has been hard hit, especially given distress in rural India where incomes have been subdued. That’s translated into an abrupt slowdown for makers of corner-store staples from toothpaste to shampoo.

After betting big on a push into India’s vast agricultural hinterland, players from Unilever NV’s local unit to homegrown firms like Dabur India Ltd. and Godrej Consumer Products Ltd. are reporting slowing growth. Depressed crop prices, a financing squeeze and prospects of weak rainfall have combined to make India’s farmers warier of shelling out extra rupees.

From almost 16% in the last three months of 2018, growth in the market for fast moving consumer goods has slowed to 13.6% in the first three months of this year, with sales of essential items in rural areas slowing the most, according to Nielsen.

In the year to March 2019, production of consumer non-durables grew at about a third of the 10.5% pace seen in the previous fiscal.

Autos & Steel

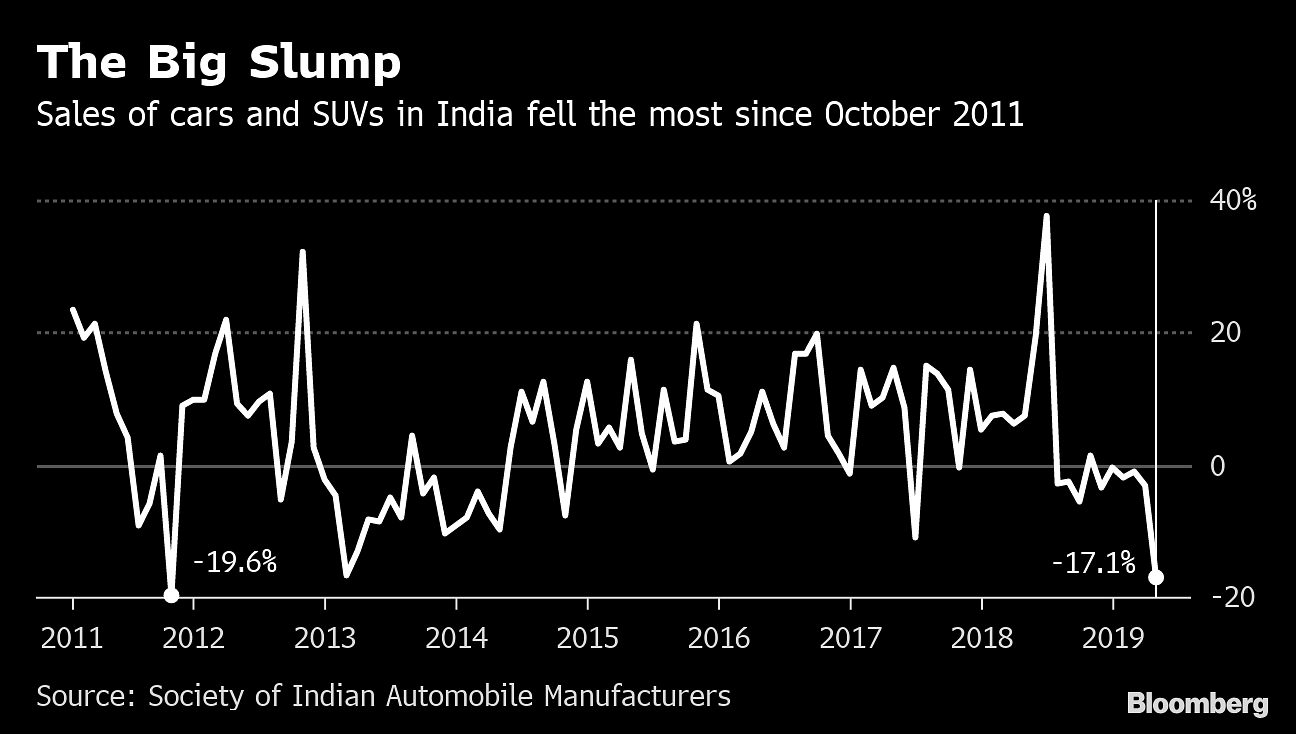

The automobile sector too is passing through a rough phase with passenger vehicle sales dropping in April by the most in seven-and-a-half years. Sumedha Dasgupta, an analyst at ICICI Bank Ltd., says a host of disruptions have roiled the sector including the recent cash crunch among shadow banks, patchy monsoons, high fuel costs and tightening insurance norms.

That demand slowdown has spilled over into the steel industry, which has ramped production up to record levels and depends on the automotive sector for about 10%-12% of demand. Steel consumption rose 6.4% in April from a year ago, slowing from 9% in the comparable prior period, due to weakness in automotive sales and a possible slowdown in construction, SBICAP Securities Ltd. said in a recent note.

Real Estate

The sector has suffered through two turbulent years, during which policy shifts cut into sales and prices. The March quarter brought good news with a 12% uptick in purchases across India’s top seven cities, though prices remained stagnant and unsold inventory declined just 1%, according to Anarock Property Consultants.

As buyers return, developers are struggling to finance projects and repay loans amid a funding crunch. “The problem is becoming worse with lenders taking possession of the collateral from the developers,” said Ashutosh Limaye, head of research and advisory services at Anarock. “These banks are finding the collateral sub-optimal to get their capital back and the projects are getting stuck.”

Oil Sector

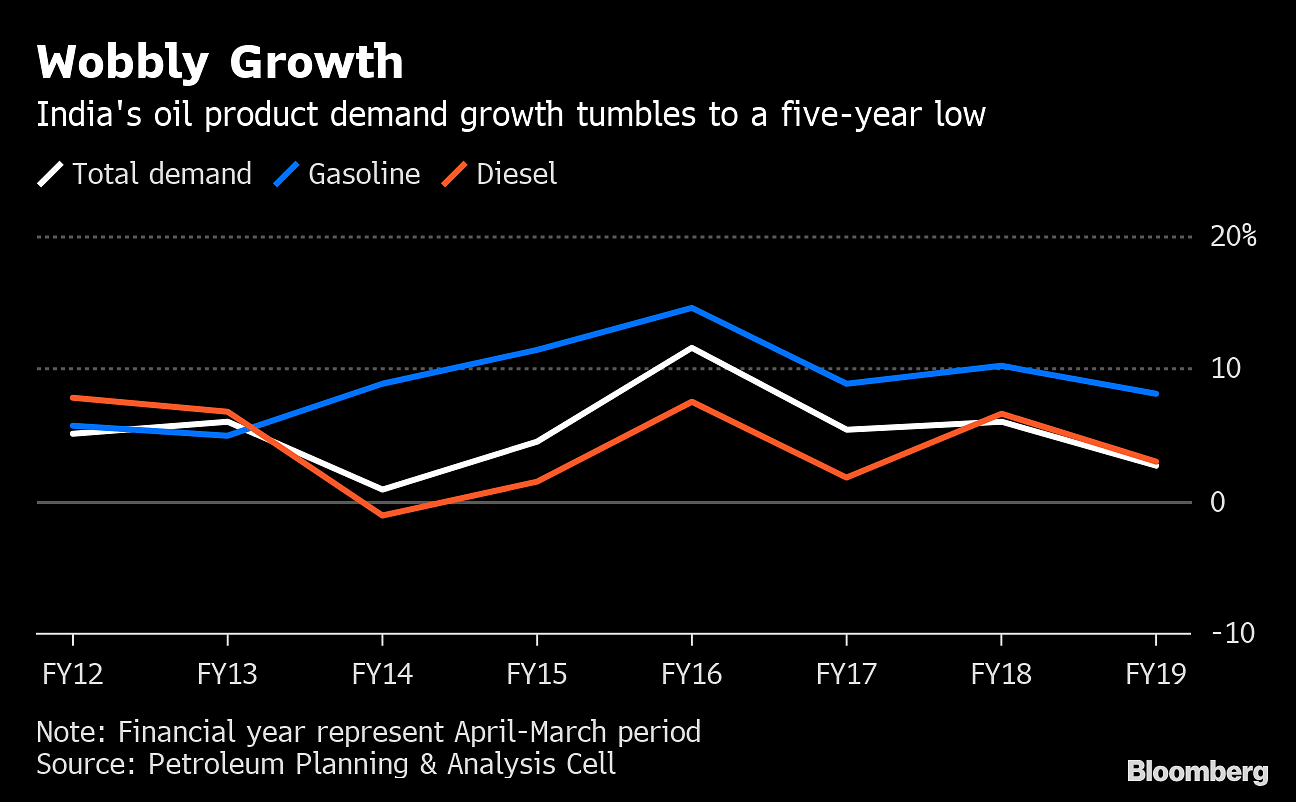

India’s oil demand growth in the 12 months through March was the slowest in five years. In April, the first month of the new financial year, oil product consumption remained little changed. Weaker industrial activity has hit diesel demand growth, while falling passenger vehicle sales impacted gasoline consumption. Going forward, a more than 30% surge in oil prices so far this year is likely to crimp fuel consumption and flow through into consumer spending as well.

Aviation

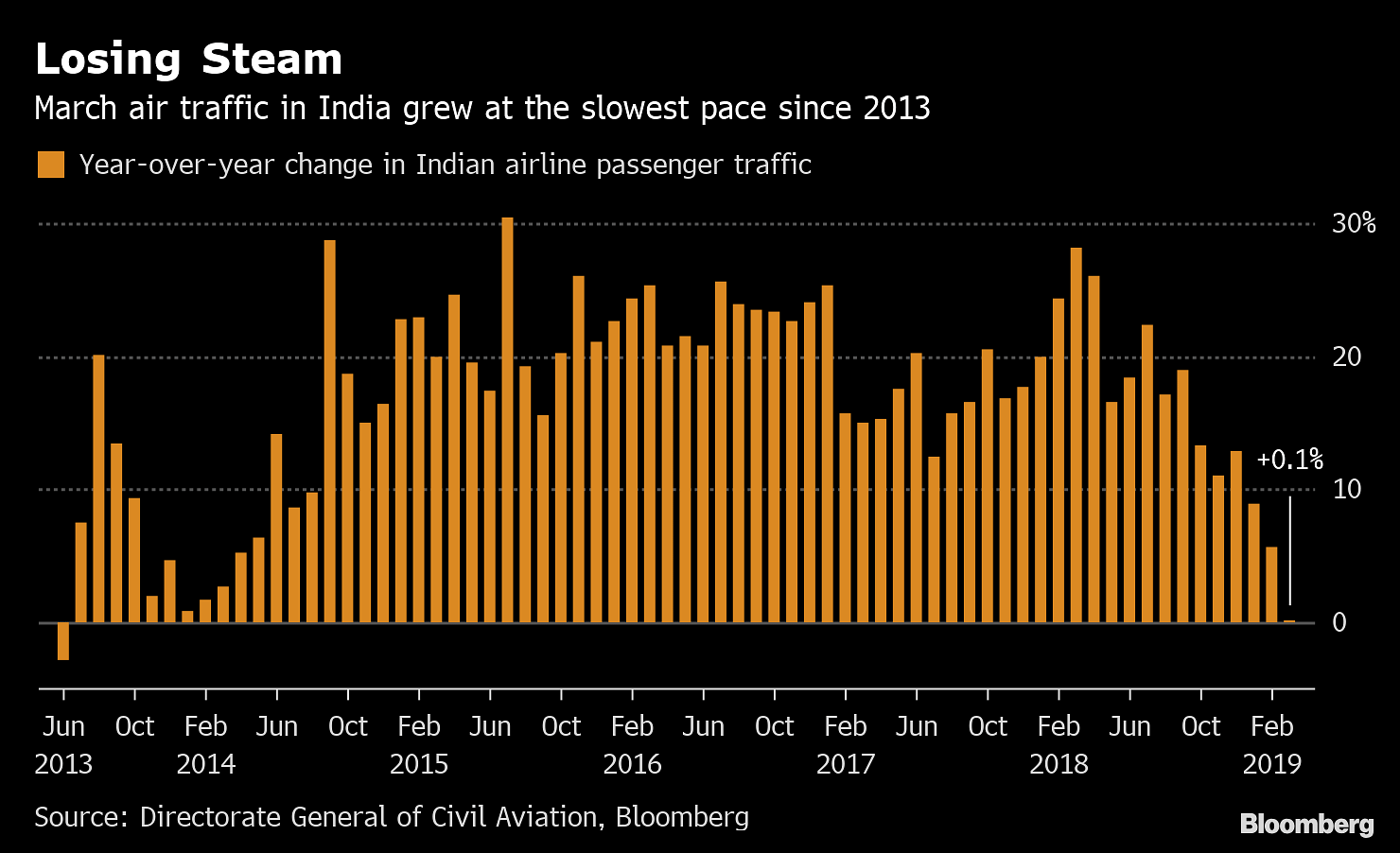

Air traffic in India, the world’s fastest-growing aviation market last year, expanded at the slowest pace in almost six years in March. Local airlines carried 11.6 million passengers in March, or 0.1% more than a year earlier. The slump came as Jet Airways India Ltd., once India’s biggest carrier by market value, was forced to suspend flights and seek a new investor.

Gig Economy

E-commerce provided a silver lining.

“Transactions continue to grow at 15% rates annually and online consumption is actually increasing quarter on quarter,” said Abhishek Chauhan, a Bengaluru-based senior director at researcher RedSeer Consulting. “Transacting users will double from the current 200 million in five years.” – Bloomberg.

Also read: Pick-up in quarterly sales reflect an upswing in Indian economy as GST regime stabilises