US, Canadian, Australian and Indian stocks hit new highs drowning fears of a trade war.

What trade angst?

U.S. stocks are at five-month highs, Australian stocks at decade highs, and equity markets including Canada and India are at or near their highest levels on record.

It’s a rally that gives the lie to all the talk that a looming trade war is about to send the global economy into a downturn. Rather, it underscores how the combination of continued central bank largess, a stronger-than-expected start to the company earnings season and growing indifference to the protectionist rhetoric emanating from Washington and Beijing are buoying risk appetite. The MSCI global index of stocks is up 2.9 percent in July, on course for its best month since January.

The trade war tension “has not yet impacted the growth of these economies on the ground,” said Jameel Ahmad, head of currency strategy and market research at foreign exchange brokerage FXTM in Cyprus. “Their valuations look attractive to potential buyers.”

The evidence of risk appetite isn’t limited to stock markets. U.S. credit spreads have been falling this month and demand for so-called havens has been lackluster. U.S. 10-year Treasury yields have jumped 11 basis points in the past two weeks, the yen has been trading above 110 to the dollar for the longest stretch since January and gold is at a one-year low.

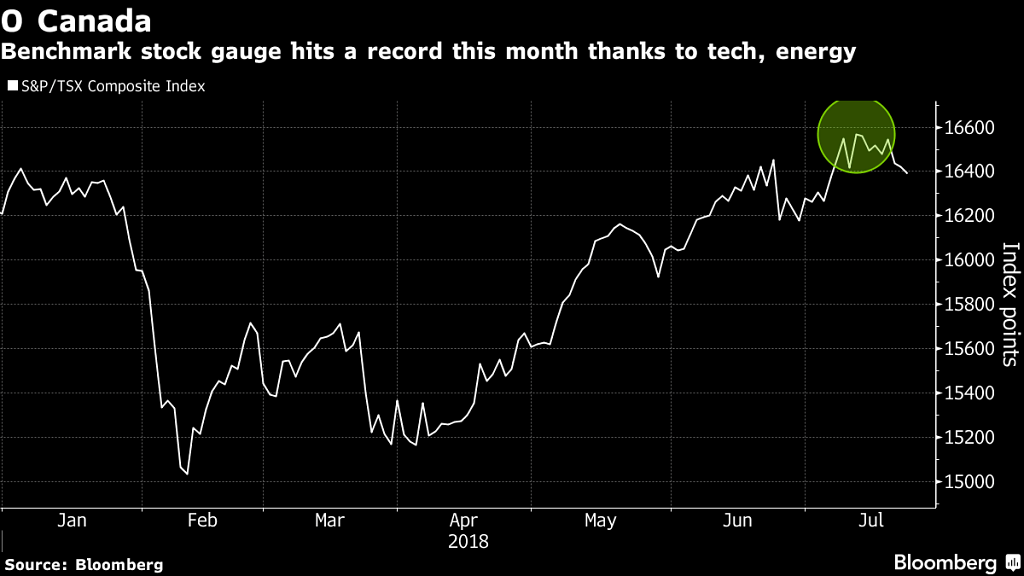

Record High

Canadian stocks touched a record on July 12 despite the country being at the heart of the trade dispute due to ongoing Nafta talks and Trump’s fixation with dairy. Technology companies led the way, with e-commerce company Shopify Inc. among the biggest gainers, while oil producers have also rebounded with the price of crude and the economy shows ongoing signs of strength.

India’s benchmark stock index has risen more than 8 percent so far this year, surpassing a previous all-time high reached in January, for one of the best performances among major Asian markets. The world’s fastest-growing major economy is relatively insulated from trade risks due to its massive domestic market and a burgeoning middle class.

Analysts at UBS Group AG including Bhanu Baweja said in a research note that credit markets may be ignoring the potential impact of tariffs, warning that U.S. high-yield spreads could widen as much as 200 basis points if there is a full-fledged trade war.

Luke Hickmore, a senior investment manager at Aberdeen Standard Investment in Edinburgh, says those risks are now looking overblown, and the market should focus instead on corporate earnings, many of which are beating analyst expectations. Hickmore forecasts a “very good” earnings season in the U.S. and a “pretty good” one in Europe.

“We could be at the start of a new risk-on phase for markets for at least the next few weeks,” Hickmore said in an interview with Bloomberg TV on Tuesday. “The Trump-trade stuff is becoming background noise.” –Bloomberg