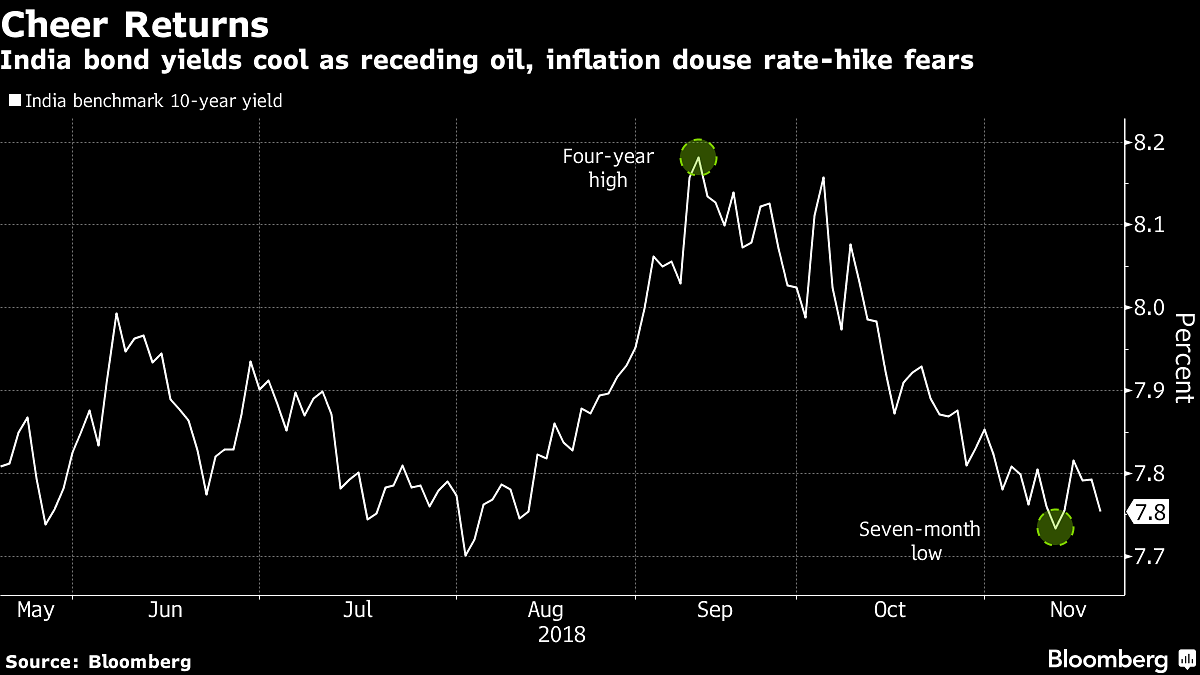

Expectations of rate increase by the RBI have weakened after the slump in price on Brent crude.

Mumbai: Oil’s price collapse is driving India’s sovereign bonds to their best quarter in more than a year.

Expectations of rate increases by the central bank have weakened after the slump in the price of Brent crude — India’s top import — and the easing in retail inflation to a 13-month low. The debt-buying support from the Reserve Bank of India has given investors another reason to cheer the end of the longest stretch of losses since 2011.

“Given that rates are likely to remain unchanged on the back of a decline in inflation and a significant drop in oil prices, and growth likely to slow down, the outlook for bonds is fairly sanguine,” said Suyash Choudhary, head of fixed-income funds at IDFC Asset Management Co., which oversees 697 billion rupees ($9.9 billion).

The RBI in October held rates after back-to-back hikes since June, and is due to review policy next month. A report on Nov. 30 may show economic growth in the July-September period was the slowest in three quarters, according to a Bloomberg News survey. There’s optimism the data would prompt the central bank to keep financial conditions a bit easier.

The 10-year yield has slid more than 50 basis points from a four-year high in September and the rupee is Asia’s best performing currency this month, as global funds returned to the nation’s equity and debt markets. The 30-stock S&P BSE Sensex has risen about five percent from a seven-month low reached end-October.

To be sure, the political uncertainty because of ongoing state polls and their impact on the national election in mid 2019 may inject some anxiety from time to time, said Choudhary, who’s bullish on five-year sovereign bonds.

“I wouldn’t worry too much about the uncertainty premium and would rather focus on the growth-inflation trade-off as it’s evolving,” he said.

Indian markets were closed Friday for a local holiday.-Bloomberg