BNP has added Bajaj Finance, Kotak Mahindra Bank, Reliance Nippon Life Asset Management, SBI Life Insurance & HDFC Standard Life Insurance to its buy list.

Mumbai: Beaten down Indian stocks aren’t out of the woods yet, though there may be buying opportunities among financials that bore the brunt of the rout in the $2 trillion market, according to BNP Paribas.

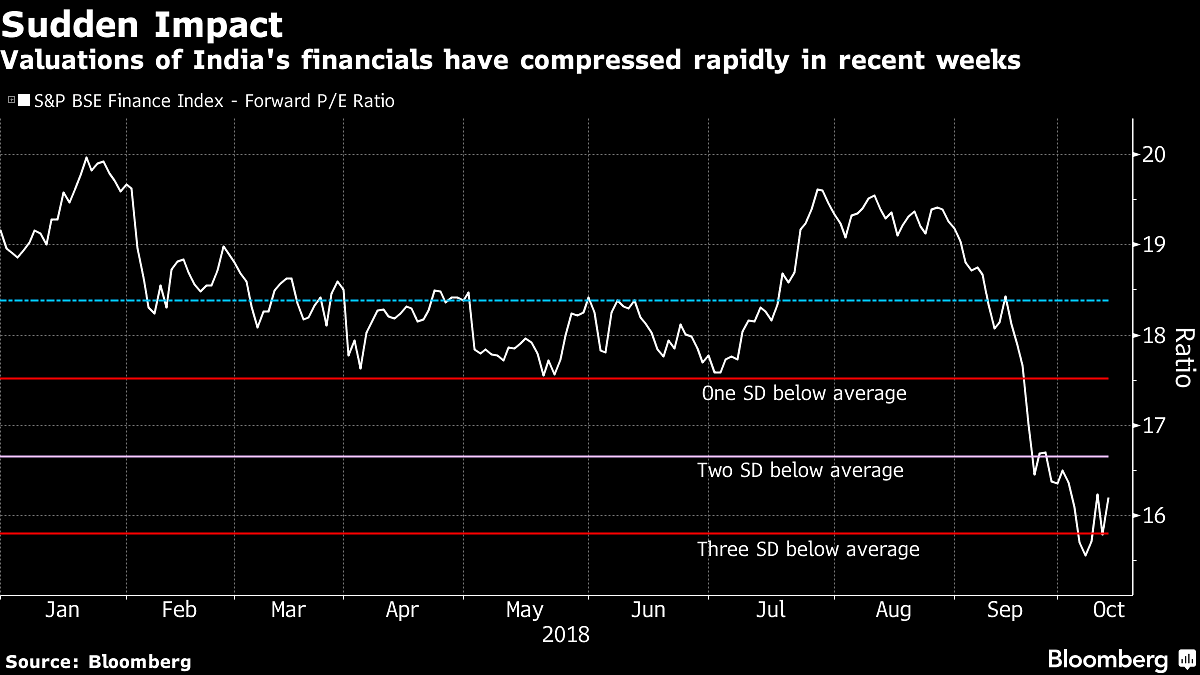

Tight liquidity and a debt crisis at an infrastructure lender last month sparked a 13 percent plunge in the S&P BSE Finance Index, the steepest in almost a decade. That aggravated the sell-off in the broader market already reeling under a tumbling rupee and high oil prices.

Private lenders, life insurers, mutual fund firms and non-bank finance companies whose assets exceed liabilities maturing over the next year are “comfortably placed,” Abhiram Eleswarapu, head of equity research at BNP Paribas Securities India Pvt., said in Mumbai.

“If you juxtapose this with their now reduced valuations, some names look interesting,” he said in an interview, without identifying any stocks. “It is important not to paint all non-banking finance companies with the same brush.”

BNP has added Bajaj Finance Ltd., Kotak Mahindra Bank Ltd., Reliance Nippon Life Asset Management, SBI Life Insurance Co. and HDFC Standard Life Insurance Co. to its “buy” list, according to the brokerage’s Sept. 24 report. These stocks tumbled between 11 percent to 26 percent last month.

The extent of the price erosion and the spike in volatility has created opportunities for bottom up stock pickers, Eleswarapu said. The NSE Nifty 50 Index trades at 18 times estimated earnings, higher than the five-year mean, even after the gauge slid into a correction earlier this month. That leaves it vulnerable to further declines, he said.

“The sell-off has made valuation a bit cheaper but the Nifty and the BSE500 indexes are trading well above their historical averages and that hasn’t changed in over a year,” he said. “So any negative news is not taken kindly. We continue to advocate a bottom-up stock picking approach.”

Some other comments Eleswarapu made:

Rising oil prices, risks of a full-blown trade war and elections in three key states later in the year ahead of the national polls in 2019 could keep the markets volatile. Our end-December Sensex target of 37,500 has about 9 percent upside. India is also rated neutral in our regional portfolio. Earnings at the 50 Nifty companies mayo rise by an average “low-to-mid-teen” in the September quarter, boosted mainly by exporters, energy and consumer firms. The RBI is more inclined to look at inflation as a guide for its next step and raising rates may hurt growth that has just started picking up; there isn’t sufficient evidence that rate hikes help the currency as we have seen in some other emerging markets. – Bloomberg