New Delhi: In April 2016, the Modi government set up the Banks Board Bureau (BBB) and touted it as some kind of a silver bullet to address the woes of the country’s public sector banks.

But three years on, a look at the report card of the much-hyped outfit shows it has achieved little of what it set out to do.

Formed as part of Mission ‘Indradhanush’ — a seven-point revamp programme for state-owned banks — the board was to act as a link between public sector banks (PSBs) and the government.

Its main task was to reinvent PSBs, make them more efficient, chalk out a merger strategy and roll out a well-constructed talent policy with revised salary structure and employee stock option plan (ESOP). Former Comptroller Auditor General of India Vinod Rai, who was appointed as the board’s first chairman, had ideas even to reduce the number of state-owned banks to about six from the present 21.

According to a Reserve Bank of India (RBI) recommendation, the BBB was also to be morphed into Bank Investment Company (BIC), which was envisaged as the holding company for PSBs.

Three years on, despite Finance Minister Arun Jaitley’s repeated statements about the government’s need to distance itself from the functioning of PSBs, none of these steps have been taken.

The role of the BBB has only been confined to selection of chairmen and other senior officials of the bank boards.

“The government continues to exercise its authority over the public sector banks, nothing much has changed from what it was earlier — on credit, on expansion and even appointments of chairmen have to go through the Appointments Committee of the Cabinet,” a senior government official who has worked closely with the BBB told ThePrint on condition of anonymity.

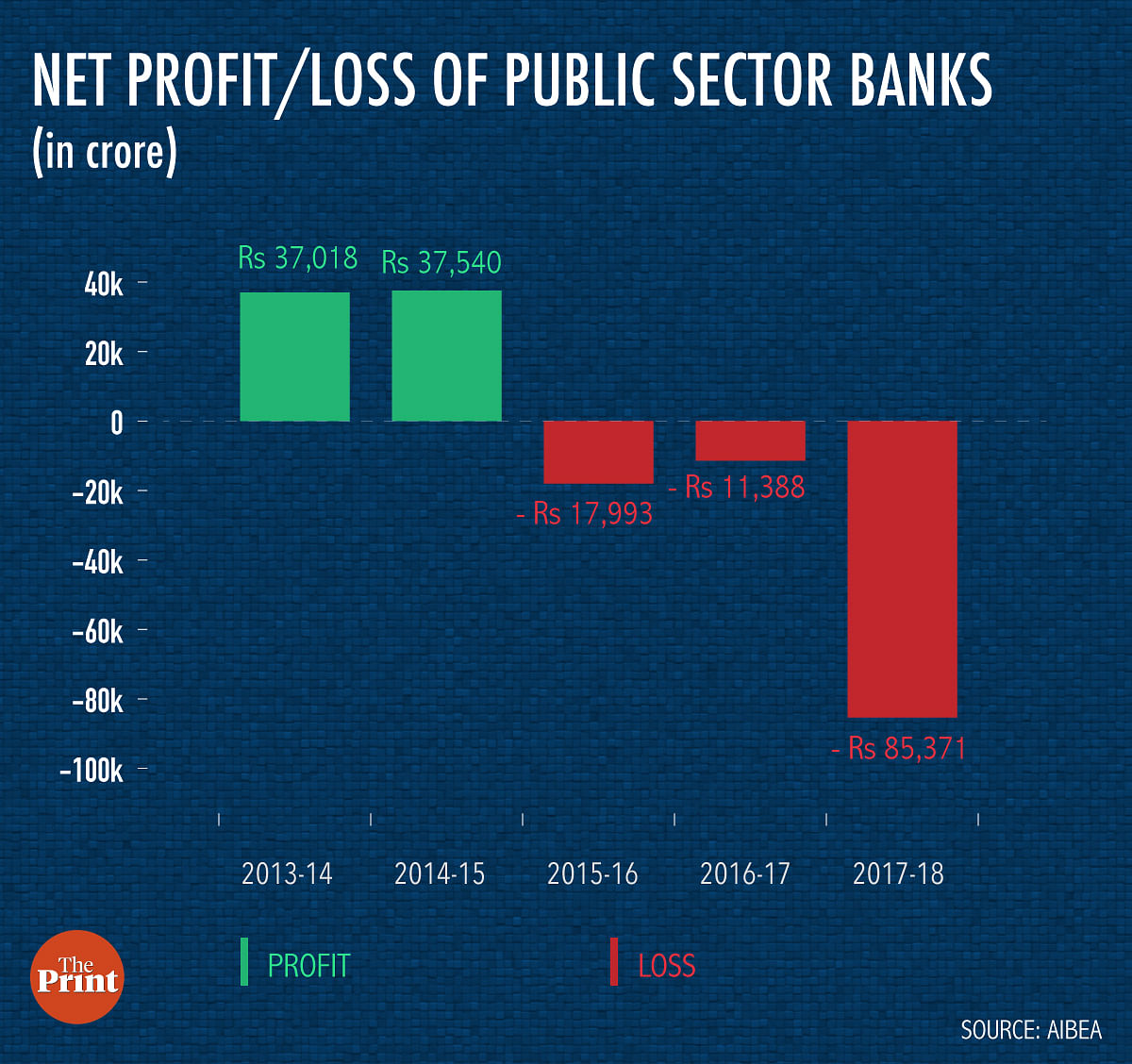

The PSBs’ annual numbers also present a telling story.

In fiscal 2015-16, before the BBB started operations, PSBs reported a net loss of Rs 17,993 crore. The next year, the losses narrowed a bit to Rs 11,388 crore before rising to a staggering Rs 85,371 crore in 2017-18, data from the All India Bank Employees Association shows.

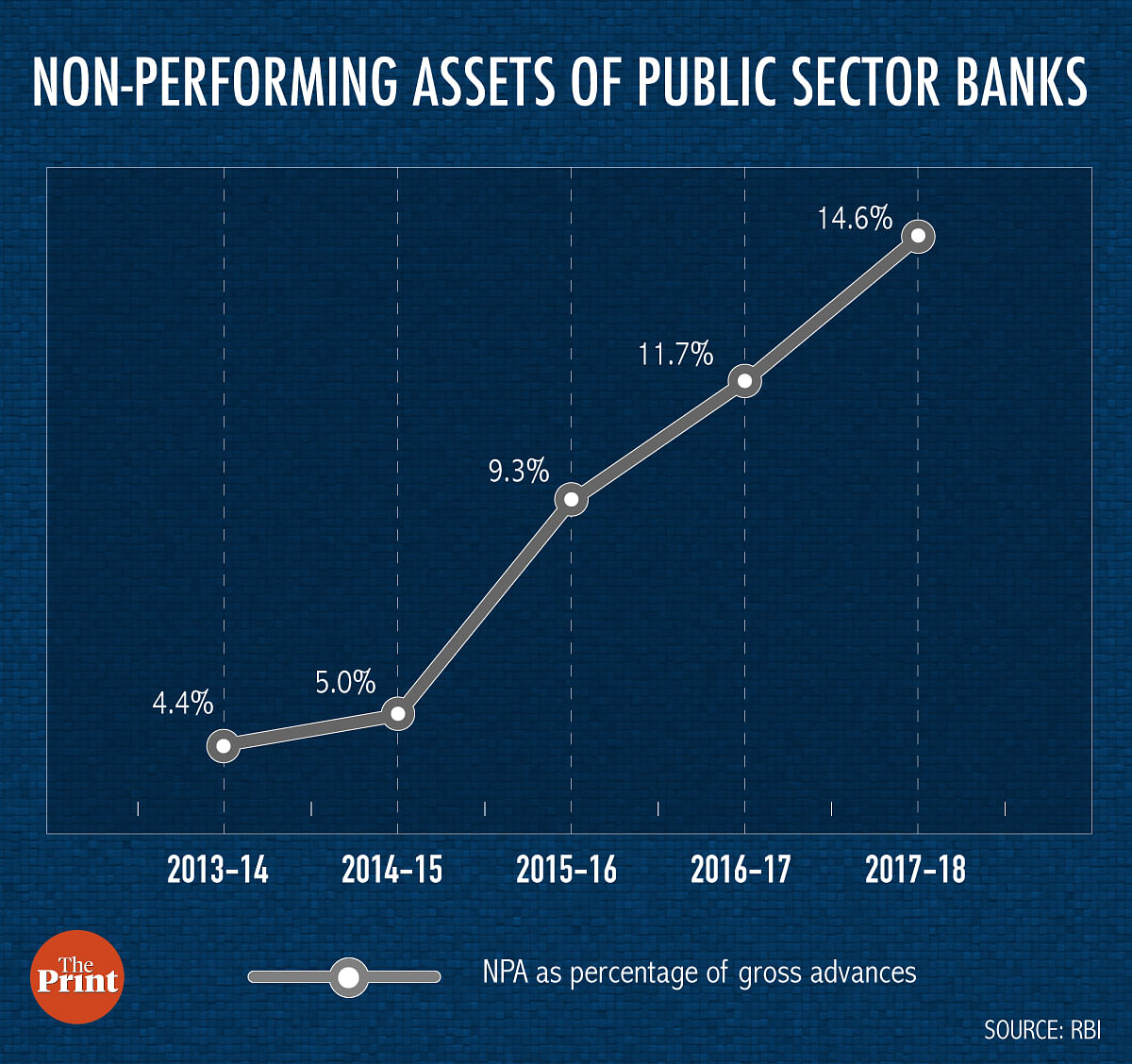

During the same period, the non-performing assets (NPA) of PSBs as a percentage of gross advances increased from 9.3 per cent (FY16) to 11.7 per cent (FY17) to touch 14.6 per cent in the last fiscal, RBI data shows.

However, a senior finance ministry official said BBB has been effective and its recommendations on top level appointments have been incorporated.

“It is just three years. It is too early to say that it is a non-starter. For any new department to stabilise before it runs takes time. For some it takes a little longer and for some others it may take lesser time,” said the official who didn’t wish to be named.

ThePrint reached Rai and chief economic adviser Krishnamurthy Subramanian for comment but there was no response until the time of publishing this report.

Also read: India’s next govt needs to axe public sector banks to push growth

‘Compensation, leadership’

Under the leadership of Rai, the Banks Board Bureau started off well, holding regular meetings and submitting several recommendations. In the initial months, the board wasn’t even given a proper office, said an analyst who didn’t want to be named.

In the two years of Rai’s tenure, the board made several recommendations — on compensation and remuneration at par with private sector banks to attract and retain the best talent; a strategy to roll out ESOPs; building leadership qualities and focus on succession planning.

However, the implementation of the recommendations wasn’t taken up, the sources said.

Last year, the government appointed former Department of Personnel & Training (DoPT) secretary Bhanu Pratap Sharma as the chairman of the board.

“Govt renews commitment to not interfere in Sr level appointments in PSBs,” financial services secretary Rajeev Kumar had tweeted in April last year, while announcing Sharma’s appointment.

Govt renews commitment to not interfere in Sr level appointments in PSBs. Appoints new BBB with professionals with diverse expertise to select top management in PSBs. BBB Recommendations made so far incl HR reforms agenda to be taken forward. @PMOIndia @FinMinIndia @PIB_INDIA pic.twitter.com/d4qSRaOblM

— Rajeev kumar (@rajeevkumr) April 12, 2018

However, since Sharma and the new board took over, the BBB’s remit has been limited largely to appointments.

How it came about

In January 2014, then RBI governor Raghuram Rajan had set up a committee to prescribe ways to resolve the issues plaguing India’s public banking sector.

Under P.J. Nayak, former chairman and chief executive of Axis Bank, the committee recommended sweeping changes, underlining the need to provide these banks with a level playing field with their private sector peers.

It proposed that the government “distances itself from several bank governance functions” and recommended that the “Bank Nationalisation Acts of 1970 and 1980, together with the SBI Act and the SBI (Subsidiary Banks) Act, be repealed” and “all banks be incorporated under the Companies Act”.

The committee also proposed the formation of a Bank Investment Company (BIC) “to which the government transfers its holdings in banks”.

Almost a year later, the BBB was announced as part of the Modi government’s Indradhanush programme on 14 August 2015.

The BIC is nowhere in the picture yet.

Also read: RBI is struggling to get banks to cut interest rates

‘Not easy’

A senior government official said the recommendations of the BBB are not easy to implement.

“These are government banks that we are talking about. It is not easy to carry out mergers or even reduce Centre’s shareholding,” said the official who spoke on condition of anonymity.

Ashvin Parekh, banking expert and managing partner at APA Services, said that while the Nayak committee jotted down the problems of the public sector banking and chalked out a roadmap for its revival, the government never managed to alienate itself from its lenders.

“The banking system is important for growth and other social activities, and the governments — does not matter which party is in power — have used the banks for this purpose,” Parekh said.

Another government official pointed out that even the BBB’s role in appointments of senior bank officials is limited.

“Till the time these appointments have to be approved by the ACC, the board has practically no teeth even in the selection process,” said the government official.

Last week, the BBB submitted yet another report seeking autonomy for the PSBs to decide on their organisational structure even as it recommended 75 names for leadership roles in public banks.

Banks Board Bureau, like UDAY and Indradhanush, is timepass. One is surprised how a mandarin of the caliber of Shri Vinod Dua deigned to head it. For the exceptional promise of the mandate of 2014 to have been realised, the PSBs ought to have been privatised.

Vinod Rai … Two people whose Hindustani I quite enjoy listening to are Vinod Dua and Arfa Sherwani.