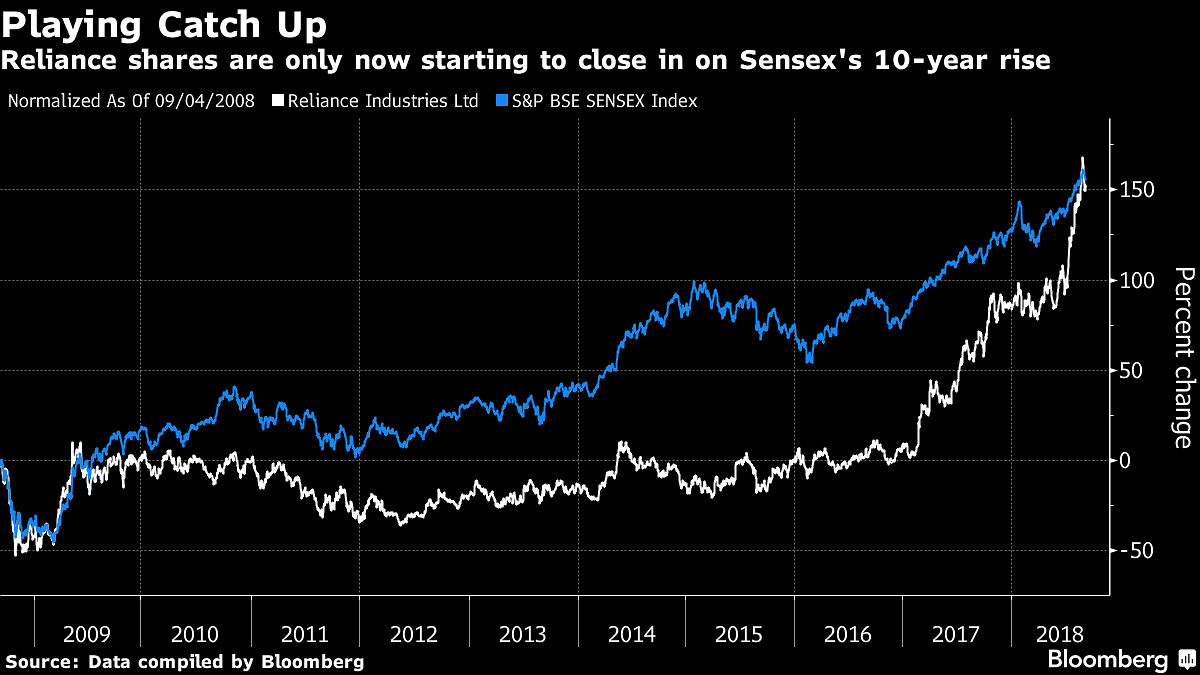

Shares have gone up by 135% and Reliance now stands first in the 30-stock index.

Mumbai: Reliance Industries Ltd.’s recent gains are helping one of India’s most-valuable companies catch up with the benchmark index, which it had trailed for much of the past decade.

At close of trading Wednesday, the company’s shares had surged 135 percent since it launched telecom services in 2016, nearly four times the advance in the S&P BSE Sensex, making it the best performer in the benchmark index. That brought its 10-year gain to 149 percent, just shy of the Sensex’s 155 percent advance. Reliance shares climbed 2.8 percent on Thursday, adding to an advance this quarter that would be the steepest since 2009 if maintained.

For seven of the 10 years through December, the retail-to-refining giant trailed the Sensex, partly due to doubts about Reliance’s $35 billion bet on telecom.

“Reliance is coming out of a long period of consolidation,” said Nikhil Bhatnagar, head of global capital markets at Auerbach Grayson & Co., a brokerage firm based in New York. “The market was quite pensive on their abilities to build a sustainable telecom business.” The company’s investment in retail was also “a balance sheet drag,” he said.

Some of those concerns have been put to bed after Reliance Jio Infocomm Ltd. amassed 215 million users and started posting profits. “The company is challenging the market’s perception around Jio’s profitability and efficiency,” said Nitin Tiwari, a Mumbai-based analyst at Antique Stock Broking.

Jio’s success has also given investors confidence that Reliance can disrupt other sectors. Chairman Mukesh Ambani’s July 5 announcement on expanding Reliance’s e-commerce presence — challenging global leaders such as Amazon.com Inc. and Walmart Inc. — triggered a surge in its shares.

With plans to leverage its telecom subscriber base to bolster online retail, Ambani would be a formidable rival, according to Auerbach’s Bhatnagar.

“If done right, it could help Reliance dwarf Walmart, Amazon in India over the next decade,” he said. The real concern, he said, is profitability given competition and the investments required in retail and telecom. “Owning Reliance had no better outcome than owning the index over the last decade and I don’t anticipate that changing over the next 10 years.”- Bloomberg

Go reliance! Kick the colonialists ass.