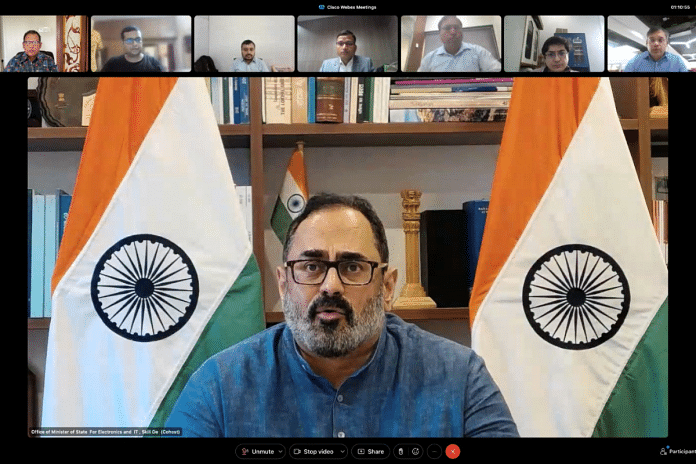

New Delhi: Union minister Rajeev Chandrasekhar on Tuesday interacted with over 450 startups impacted by the recent collapse of Silicon Valley Bank (SVB) and assured their representatives that the government is “laser-focused” to help them tide over this crisis.

“We will share a list of suggestions with Finance Minister Nirmala Sitharaman and explore how best your concerns can be addressed. We will also explore how smoothly we can facilitate the transfer of your US dollar deposits to Indian banks, IFSC centered foreign banks or any other Indian bank which has presence in the United States,” the Minister of State for IT said in a video conferencing meeting.

Among other issues, attendees, which included startups owned/co-owned by Indians, venture capitalists and other stakeholders, raised concerns about transfer of their US dollar deposits to India and to US-based branches of Indian banks. Startups like Zoth.Io, Hatica.Io and VCs and financial service providers like Blume VC and Mirae Asset were part of the meet.

According to a government release, Chandrasekhar said that for those startups whose “deposits were going to be made whole, but have no access to it currently, we will explore the option of whether any credit lines can be made available in US dollar or Indian rupees”.

The government will also try to see if more credit products, like in the US, can be made available to startups and make it easier for them to move from the SVB to any other Indian bank in the US, it added.

The minister said the Indian banking system was robust and suggested that the start ups could explore using it. “The Indian banking system is most stable and robust and you must explore it as part of your organisational framework. While startups have a natural incentive to use banks like SVB, we must figure out a way to use the Indian banking system without changing your business model,” he added.

This consultation, the release said, was part of the government’s approach to address the situation and offer any assistance to members of India’s innovation and startup ecosystem who had financial holdings in the SVB.

Chandrasekhar assured the participants that the government would do “everything possible to navigate the storm caused by the bank collapse”, and asked them to approach the CEO, MeiTY Startup Hub for any problems that they were facing.

Widely known for lending to tech startups, the SVB was shut down last week by the Federal Deposit Insurance Corporation (FDIC). The FDIC announced that the California Department of Financial Protection and Innovation was shutting down the SVB and that depositors would have access to their insured deposits over the next few days, causing panic among the startups, depositors and the entire banking system.

(Edited by Tony Rai)

Also Read: 28% of India’s borrowers now women, have better risk profile than men, says CIBIL report