The Union Budget 2023 is well balanced by pushing the ambit of capital expenditure even further without compromising on the fiscal discipline. The measures announced by Finance Minister Nirmala Sitharaman are oriented toward improving the purchasing power of households, empowering women and enhancing the prosperity of agriculture and MSME sectors. All well thought out and reasonable.

The new tax regime

The Budget proposes to move to a clutter-free new tax regime. Currently, the incentives tend to violate the principle of equity and efficiency without generally enhancing savings at macro level. Therefore, the continuation of different tax incentives on various financial assets needed a relook. The Budget has made the right move in making the new tax regime the default option. The new tax regime distinguishes between long-term savings, and short- and medium-term savings insofar as the tax treatment is concerned.

Thus, for example, while individuals investing in Sukanya Samriddhi Yojana (SSY) for their girl child will continue to receive tax-exempted interest in the account under the new tax regime, the maturity proceeds accrued from the SSY account will also remain exempted from tax. However, investment under this scheme will not be available for tax-break under section 80C in the new tax regime. Thus, long-term savings will continue to be encouraged, thereby promoting long term financial accumulation and social security.

The government has added sweeteners to the new tax regime by reducing the number of tax slabs and bringing down the surcharge rate at the highest level. Also, the issue that the new tax regime could be regressive has been adequately addressed, with the exemption limit at the lower end increased significantly from Rs 5 lakh to Rs 7 lakh. We believe the transition to a new tax regime will be a smart move by existing taxpayers in search of simplicity and more disposable income. The overall impact of a resultant consumption multiplier will be significant.

Also read: How Sitharaman can live up to her Budget promise of KYC simplification

Tax and revenues

The tax buoyancy (based on gross tax revenues) for FY24 is reasonably estimated at 1.0 as nominal GDP growth is projected by 10.5 per cent while gross tax revenues are projected to grow by 10.4 per cent. For FY23 (RE) the tax buoyancy is estimated at 0.80. These numbers are quite reasonable and all likely could be over achieved, if we go by the current trend.

For FY24, gross market borrowing through dated securities has been budgeted at Rs 15.43 lakh crore and taking repayments of Rs 3.62 lakh crore (adjusted for recovery of Rs 78,104 crore from GST compensation fund), net market borrowing stands at Rs 11.8 lakh crore. The market borrowing numbers in the budget has avoided any negative news for the bond markets.

Also read: Budget 2023: Capital outlay sees 33% hike in infra boost. Focus on Nal Se Jal, PM Awas scheme

What MSMEs, women gain

The Budget laid much-needed importance on the MSME sector, which is still recovering from the pandemic-induced challenges. The infusion of Rs 9,000 crore corpus for revamped credit guarantee scheme significantly addresses the credit gap and is aimed at enhancing credit access, thereby paving the way to encourage entrepreneurship in the country. The PM VIKAS scheme will enable the rural artisans to improve the quality, scale and reach of their products, and integrate them with the MSME value chain.

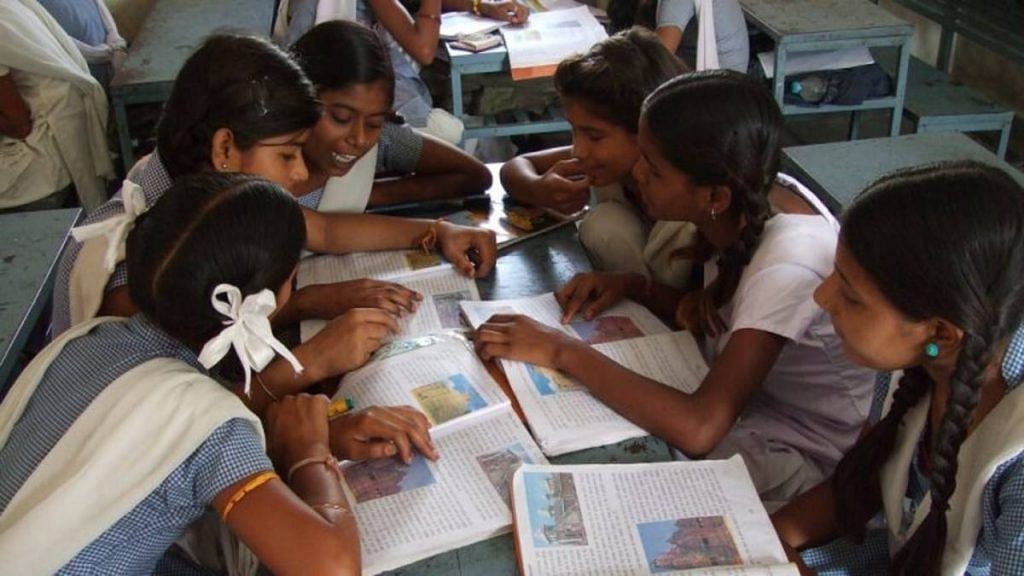

The Budget continues to empower women. The Deendayal Antyodaya Yojana National Rural Livelihood Mission has achieved remarkable success by mobilising rural women into 81 lakh Self Help Groups. Digital public infrastructure for agriculture will be built as an open source, open standard and interoperable public good. This will reduce the lending cost for the farmers.

The Budget also laid focus on another important aspect — the introduction of National Data Governance Policy, which will ease the KYC process and reduce privacy breaches. It will also enhance the use, access and quality of data and improve the government’s data collection and management while enabling inclusive development. This is still at a very nascent stage and will require consistent efforts to truly create a digital economy.

Overall, the Budget has a vision towards creating an Amrit Kal in every aspect.

Soumya Kanti Ghosh is Group Chief Economic Advisor, State Bank of India. Views are personal.

(Edited by Anurag Chaubey)