As money gets dearer the world over, it makes sense to lock into the current cost of funding to as great an extent as you can.

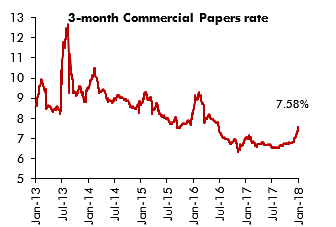

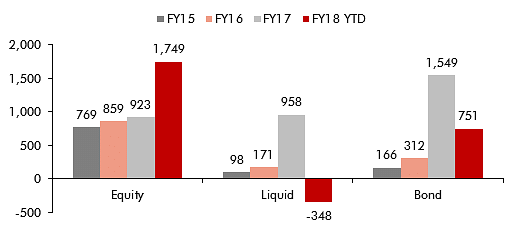

To the chagrin of several bond fund managers, I wrote a note in April 2017 saying: “Even more than equities, the Indian bond and liquid funds are enjoying an unprecedented boom; close to Rs 4 trillion (US$60bn) has entered bond and liquid mutual funds in India over the past three years. These monies have led to a steady drop in the cost of wholesale market money; 3-month certificate of deposit (CD) and commercial paper (CP) rates are now close to or below the RBI’s repo rate. Naturally, therefore, there has been a surge in negotiable certificate of deposit (NCD) issuance by non-bank lenders over the past year in spite of a deterioration in the underlying fundamentals of these lenders…Such a deterioration could then put at risk the value of the NCDs purchased by the mutual funds and thus expose Indian investors in bond and liquid funds to a risk of capital loss.”

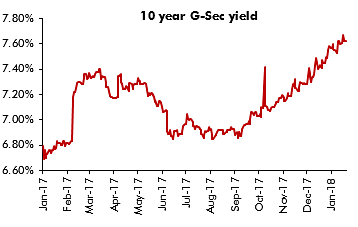

In the months following the publication of this note, Indian bond yields have risen sharply both at the long and the short ends of the yield curve — see exhibits below — and inflows into liquid funds (which invest in paper with maturity less than a year) and bond funds has dropped sharply (see Exhibit 3). I reckon these trends will continue over the next 12 months and debt funding will get significantly more expensive.

Exhibit 1: 3-month CP rate

Exhibit 2: Ten-year Indian Government bond yield

Exhibit 3: Mutual fund inflows into liquid and bond funds have been impacted

Bond yields will continue to rise

At the long end of the yield curve, there are four compelling reasons why Indian government bond yields will continue to rise:

- The US 10-year government bond yield, which is the world’s risk-free rate so to speak, has risen 63bps over last six months and stands at 2.85 per cent. This number looks set to push through the 3 per cent level as American wage settlements push upwards in a country characterised by full employment and rising commodity and oil prices.

- CPI inflation in India is at 5.1 per cent and we reckon it will move towards 5.5 per cent driven by: (a) The rising fiscal deficit which has slipped by 30bps in FY18 and looks likely to slip by more in FY19 as general elections approach; and (b) The government’s announcement that it will do whatever it takes to hike crop support prices [food accounts for half of the CPI basket]. Click here to read our 5 January note on rising inflation.

- Public sector banks in India already have an excess holding of SLR bonds (basically government bonds) and, basis guidance from the RBI, they seem unlikely to be big buyers of government bonds in the forthcoming auctions. Given that PSU banks are the largest buyers of governments bonds, this will exert downward pressure on the prices of such bonds – read here.

- As the economy recovers (we expect GDP growth to be 7 per cent in FY19 vs 5.8 per cent in FY18), most banks would rather lend money in the real world rather than park their capital in government bonds, thus pushing down the price of these bonds.

I will be surprised if a year hence the 10-year Indian government bond yield isn’t closer to 8 per cent. (Note: the same figure was at 8.8 per cent when the NDA took charge in May 2014.)

At the short end of the yield curve — in the 3-month CP and CD market — rates will also continue to rise. In addition to the reasons listed above (which apply, albeit partially, at the short end of the yield curve), the biggest challenge for the CP and CD market is the ongoing economic recovery. As the economy recovers, large corporates’ treasuries are pulling out money from liquid funds (see Exhibit 3) to finance working capital requirements of their growing businesses.

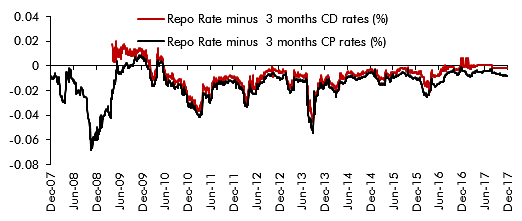

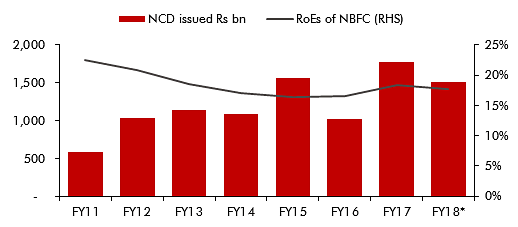

Secondly, the pricing of credit in the money market still seems to be out of whack with reality. For example, we have NBFCs — with inherently fragile business models and with return on equities (ROEs), which are structurally challenged — borrowing at more or less the same rate as state governments! In fact, as shown in Exhibit 4, the pricing of short-term money market paper is so fine that it does not build in any risk premium over the RBI repo rate. That cannot be a sustainable state of affairs given the rapidly rising non-performing assets (NPAs) of many prominent NBFCs.

Technical note: Certificate of deposits (CDs) are short-term instruments issued by a bank to a person depositing money at a predetermined rate. Commercial papers (CPs) are short term, generally, unsecured promissory notes issued by companies at a predetermined rate.

Exhibit 4: The RBI’s repo rate is in line with wholesale market borrowing rates and that does not appear to be a sustainable situation

Exhibit 5: Even with declining RoE, the issuance of NCDs by NBFCs has gained momentum

So what should investors do?

As explained by our Banks & Financial Services team in their superb note dated 12 January, non-bank lenders are obviously the most exposed to this correction in the cost of money. The longer the tenor of their assets, the greater the vulnerability of their business models. In specific, housing finance companies appear more vulnerable than auto loan and consumer durable loan providers.

Over and above the challenge that housing finance companies face in the market, the triple whammy of RERA, GST and the Insolvency & Bankruptcy Act has left them scrambling for cash — see our November 2017 thematic. Only the bravest of the brave will be able to hold on to these stocks as they roiled over the next 12 months.

Brokerages and investment banks that have built lending-related businesses will see downward pressure on their shareholders’ equity as NPAs rise and alongside this the cost of money rises. Several of these brokers-cum-lenders have smartly raised equity over the course of the winter and others have merged themselves into banks. Those that have not done either face a long 12 months ahead of them.

Banks with strong current account and savings account (CASA) franchises will benefit significantly over the next 12 months because in an improving economic climate they will be able to lend money at lower rates than their non-bank competitors. Especially in home loans and working capital funding for small & mid-sized businesses, I expect to see the CASA funded banks to come roaring back into the mix. That being said, even for these banks — and hence for their clients — I reckon the cost of loans will rise by around 75bps over the next 2-3 quarters as the economic recovery increases demand for credit. At present, home loan rates and state governments’ borrowing rates are similar (around 8.3 per cent). That does not feel sustainable to me and I believe that with rising credit demand, the banks will hike their home loan rates significantly in the coming months.

At the level of the overall stock market, I reiterate my view that the Sensex is still 10-15 per cent overvalued (for details click here for our 12 February note) and Indian small-midcaps are even more egregiously overvalued. Finance 101 says that when the cost of capital rises, the riskier the asset the deeper the asset price correction.

As money gets dearer the world over, regardless of whether you are running a business or a household, it makes sense to lock into the current cost of funding to as great an extent as you can. With the post-Lehman era coming to an end, the longer you can live in the fantasy world of cheap credit the better.

Saurabh Mukherjea is the CEO of Ambit Capital Pvt. Ltd. This analysis originally appears in ‘The Sceptical CEO’ section of the Ambit website.