The Modi government has announced a massive, ambitious plan to recapitalise ailing public sector banks by injecting Rs 2.11 lakh crore into them over the next two years. Besides reviving PSU banks struggling to deal with their mountain of non-performing assets, the move also aims to stimulate growth and create jobs.

But is this mere financial engineering that hopes to boost sentiment? Or should the government have moved on this much earlier?

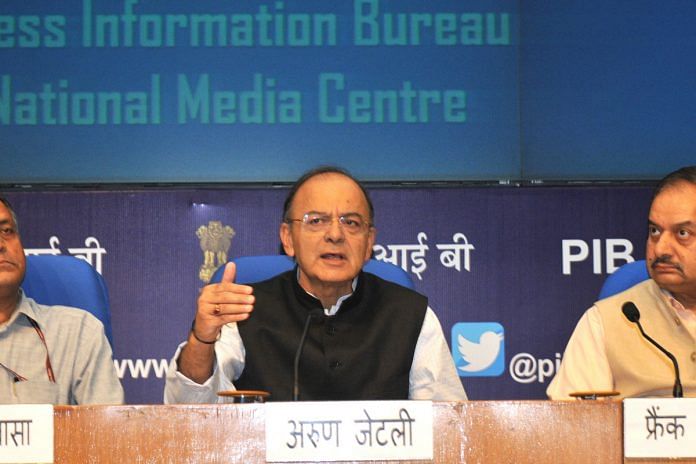

Is the Finance Minister’s stimulus enough to revive public sector banks, stimulate borrowing and catalyse investment? We bring sharp perspectives from experts.

Recapitalisation is correcting the original sin at a significantly higher cost

Praveen Chakravarty

Praveen Chakravarty

Visiting Senior Fellow, IDFC Institute

Recapitalising the public sector banking system with over Rs 2 trillion is a much-needed, long-awaited step. It is also a case of correcting the original sin at a significantly higher cost: the original sin of not recognising the scale of the bad loans problem in 2014-15; and of the hubris in believing that an inevitable high economic growth will wash off the bad loans.

In 2015, the total size of bad loans (gross NPA) in the banking sector was around Rs 3.2 trillion. Public sector banks were valued at their book value. Gross NPA was around 4.5% of total loans. Arun Jaitley allocated a measly 0.25 trillion rupees for banking sector recapitalisation in his 2015 budget.

Today, the total size of bad loans has ballooned to nearly Rs 8 trillion, PSU banks have dropped to nearly half their book value, gross NPAs have grown to nearly 10%. Banking sector woes have doubled in the last three years. Jaitley has now announced a 2 trillion rupees recapitalisation.

Further, this recapitalisation has been made possible by forcing people to deposit their cash into banks through demonetisation. The banks are now flush with Rs 2-3 trillion in extra deposits. This is now being used to recapitalise banks through an elaborate arrangement called recapitalisation bonds. Banks will give their excess cash to the government in return for bonds. The government will pay an interest to the banks, and, in turn, will inject the same cash into the banks as equity. Banks are now recapitalised with our ‘forced’ deposits without the government having to borrow from outside!

Two tempting counterfactual questions:

1. Had there been no demonetisation and excess cash with banks, how would the banks have been recapitalised?

2. Had Jaitley allocated Rs 0.75 to 1 trillion in 2015 for bank recapitalisation, wouldn’t we have been way better off?

The stimulus will clean up banks’ weak balance-sheets, but more structural reforms needed to fix deteriorating public sector banks

Radhika Pandey

Radhika Pandey

Consultant, NIPFP

The Finance Minister’s stimulus package to revive public sector banks was long overdue. Given the RBI’s stringent provisioning requirements in an attempt to clean up banks’ balance-sheet, this comes as a respite for capital-starved banks. His assurance that recapitalisation would be determined on the basis of performance of banks adds credence to the initiative.

While this serves as an immediate response to help banks tide over the problem of weak balance-sheets, more structural reforms are needed to address the problem of deteriorating health of public sector banks.

First, it is often seen that banks lend to their defaulting borrowers to help service their previous loans. This kind of ‘extend and pretend’ practise need to be checked. The recapitalisation needs to be supplemented by stringent micro-prudential measures to prevent banks from lending to hide their impaired assets.

This will open up avenues for lending to genuine borrowers. Due-diligence on borrowers needs to be strengthened to ensure flow of credit to genuine borrowers. This will spur investment growth in the economy.

The Union Cabinet has recently passed the Financial Resolution and Deposit Insurance Bill. While the Insolvency and Bankruptcy Code provides a framework for resolving failed corporate firms, this Bill provides a bankruptcy framework for financial firms including banks.

This Bill provides for the establishment of a Resolution Corporation that would ensure prompt and orderly resolution of failed banks. This creative destruction is necessary to shift capital and labour towards efficient firms. This will aid in stimulating growth.

Recapitalisation plan is a response to the deteriorating health of public sector banks. Reforms are required to address this pain point. That, in the long run would facilitate investment and growth.

The bank reconstruction and infrastructure-building packages are bold, brave, and wisely designed

Shekhar Gupta

Shekhar Gupta

Chairman & Editor-in-Chief, ThePrint

Never waste a crisis, is the old wisdom. Prime Minister Narendra Modi just wasted one. He could have used the deep crisis in our banking (confined purely to public sector banks), to launch reforms as radical as Manmohan Singh’s in 1991. Even ideologically, there would be justification in reversing Indira Gandhi’s first big socialist action, bank nationalisation. I am not suggesting he could have done it fully, but a beginning could have been made with two or three of the most stressed, smaller PSU banks.

Having got my lament as a committed pro-free market believer and equally a non-believer in state-run businesses out of the way, however, there are many positives in the new package announced by Finance Minister Arun Jaitley on the Modi government’s behalf. To expect privatisation would have been too much from an essentially statist prime minister. But the bank reconstruction and infrastructure-building packages are bold, brave, and wisely designed.

We have seen the immediate impact in the stock markets today, where the Bank Nifty is up almost 1,000 points. Figures just compiled after close of trading show PSU banks added Rs 1.19 lakh crore in market cap. Of this, the government kitty gets Rs 76 crore, so that’s cool for a day’s trading. We know market caps are notional and can change dramatically. But if the rest of the banking reform proceeds as promised, government—and the taxpayer—will be richer at the end of the day while lending and new investment gets a fresh life.

There will be the usual name-calling. Insinuating that government is giving its bank money to bailout defaulters is sheer financial illiteracy, if not intellectually dishonesty. Hard facts must be stated. Much of today’s bad debt curse was built during the UPA years. If there is a real inquiry just into the phone calls made to bank chairmen from one party general secretary’s office and that of one (only one) of the finance ministers under UPA, you’d know who filled this can with worms and sealed it.

It’s a fair point that the Modi government inherited this can of worms, let the RBI — first under Raghuram Rajan and now Urjit Patel — open it, made no calls on behalf of any cronies to evergreen, forgive, or forget bad loans. Big oligopolistic firms like Jaypee and Essar, and well-connected infrastructure czars like GMR and GVK have sold major assets to pay back banks and no maai-baap has come to their aid.

This IS progress and reform, and the markets, the fairest of judges despite their many failings, are acknowledging and rewarding this. As for our dream of somebody rolling back Indira Gandhi’s many fake-socialist missteps, we will wait for another day.

It can be quite a while before the investment cycle revives

Neelkanth Mishra

Neelkanth Mishra

India Equity Strategist, Credit Suisse

Public Sector (PSU) banks were sinking into a low-capital-low-growth vicious cycle: insufficient capital prevented them from growing their loan books, which slowed down revenues. But as costs kept rising, operating profitability deteriorated.

When combined with the losses on bad loans, this diluted the capital base even more, constraining growth further. Steadily falling share prices also impeded their ability to independently raise private capital. With the insolvency process now gaining momentum, it was feared this problem would become unmanageable.

The infusion of 2.1 trillion rupees of capital should allow these banks to fill the hole in their balance sheets created by the recognition of bad loans, and in our estimate, still leave 900 billion rupees of growth capital. As they start lending again, the vicious cycle breaks at least for now: with loans-to-equity ratio for PSU banks nearly 10, it means they can potentially issue 9 trillion rupees of loans: a substantial number. The increase in market capitalisation also enables some of them to access private capital for growth.

At this stage there is a demand problem for loans as well, but as this sharp increase in banking system capacity drives interest rates lower, some loan growth will get triggered: that is how business cycles work.

It can be quite a while though before the investment cycle revives. There are other constraints that need addressing. This also does not solve the structural problems with PSU banks of poor operating processes, undisciplined lending, weak technology, and an ageing workforce. The reforms promised by the government in the coming months should seek to address such failings.

Revival of growth and investment would require a “4R’s” approach, to borrow from the Economic Survey of 2015-16

Mandar Kagade

Mandar Kagade

Consultant at the Finance Research Group, IGIDR

As the Economic Survey noted, revival of growth and addressing the “twin balance sheet” problem that Indian economy confronts, requires the “4R’s approach”. The approach comprises of recognition, resolution, recapitalization and reform.

Hitherto we have witnessed the RBI acting on the first two limbs. As for the third limb, the central government acting through the finance ministry has announced a recapitalization plan that will invest a total of INR 2.11 trillion in public sector banks through a mixture of recap bonds, budgetary support and issuing capital through the markets.

However, we are yet to witness the incumbent administration investing its political capital into pushing structural reforms in the banking sector. As the Nayak Committee had recommended, such reforms include de-coupling ownership of PSBs from management control and vesting the latter in the hands of private expertise.

It also includes conferring a statutory “safe haven” to the business decisions of PSB management from ex-post facto scrutiny by vigilance agencies and removing them from the ambit of Prevention of Corruption Act, 1988.

Illustratively, the gravity of the twin balance sheet problem would likely be far less if the bank management could proactively liquidate the NPAs on their balance sheet at steep discounts to book value of the asset for example. The risk of ex-post scrutiny however reduces their incentives to act ex ante.

In summary, structural banking reform appears to be the sine qua non for revival of growth and investment.

Views expressed are personal.

Important to watch how the government will deal with fiscal deficit issue alongside other public expenditures

Arvind Mayaram

Arvind Mayaram

IAS officer and Former Finance Secretary

I think recapitalisation of banks were sorely needed and this has been on the cards for a very long time. If you look at the July 2014 budget speech of the finance minister, one of the announcements was that the government will bring down the equity to 52% and the capital released from the sale of government shares will be reinvested in the banks. Since then there has been an intent for the banks to be recapitalised.

However, lending to corporates is actually a twin balance-sheet problem. The first is that the banks’ balance sheets are stressed on account of NPAs, bad loans and provisioning, because of which they do not have enough liquidity to lend. The other stressed balance sheets are those of the corporate, as they are over leveraged and their equities are largely eroded. Even if the banks became healthy and were able to lend, there should be enough borrowers in the market to borrow.

The second issue plaguing the corporates is that of capacity utilisation in the industry. Although enough spare capacity already exists, it is not getting utilised because of the low demand.

The third issue is the regulatory. At the moment, because of the complexity of the GST and the outfall of the demonetisation, there is a regulatory overhang which prevents expansion in this sector. This includes overzealous use of tax authorities. So, unless that eases, there will be difficulties in the investment cycle coming back, especially in the SME sector.

As far as the bank recapitalisation is concerned, there is the issue of divestment of large sums because much of will be coming through banks offering public its shares. When there is a large offering of shares in a short time, the stocks are likely to take a beating. Therefore, it will have to be staggered over a longer period of time than just two years.

The government will also have to deal with the issue of fiscal deficit in case they do not intend to cut down on public expenditure programmes, especially in the light of yesterday’s announcement by the finance minister about a major expansion in the road construction programme.

FIRST LET THERE BE A BLANKET BAN ON WRITING OFF LOANS TO GAIN ELECTROL GAINS BY ALL POLITICAL PARTIES INVLUDING THE REGIONAL PARTIES.IT WILL BE THE FIRST STEP FOR STREAGTENING BANKING SECTOR.

India’s public debt will increase by 2.1 trillion, for the entire amount, including what is shown as budgetary support, will be borrowed. The bonds of 1.3 trillion will largely be subscribed by the banks, dipping into funds deposited by the public with them. So the government’s record of preempting resources that ought to flow to the private sector will continue. 2. On the national balance sheet, corresponding to this liability of two trillion, there will be no assets in the form of petrochemical complexes, road, rail, port infrastructure. This is reimbursement of businesss losses, not creation of durable assets. The annual interest cost of about 15,000 crores will be the first charge on future tax revenues, leaving that much less money to pay for better education or healthcare. 3. Repeated bailouts – UDAY is an analagous example – of limited companies go against the grain of limited liability. Here, a dominant shareholder, instead of receiving a steady stream of dividend, capital appreciation, occasional bonus shares, is actually topping up its initial share purchase with continuing subvention payments. Minority shareholders are suffering collateral damage, vis a vis returns they would have got if they had invested in the shares of profitable private banks, which also pay income tax to the government. 4. Finance / banking is a dynamic sector for a developing country like India, which would grow faster than the overall economy. It could create many success stories like HDFC Bank. Instead, niggardly issue of licences to private banks by the RBI has kept 70% of the banking industry in the public sector, whose condition is now visible to all. By contrast, in telecom and airlines, private players have made the government owned entities largely irrelevant. 5. For the Indian economy to return sustainably to higher growth, of the magnitude that can end mass poverty, the economic orthodoxy of the late 1960s needs to be laid to rest.